Cleaning Business Tax Deductions and Accounting Tips

Think of your cleaning firm as a garden where each dollar you save is a seed that can provide your business with more significant resources.

It’s like preparing the soil for planting as tax season approaches. You can optimise your tax benefits by being aware of cleaning business tax deductions and accounting tips available to your cleaning firm, including actual expenses, home office deductions, and costs only for business use.

Like routinely watering your lawn, you can claim all your tax-deductible expenses at tax time by retaining all your receipts. You can cultivate and expand your company’s financial stability through meticulous planning and upkeep, ensuring that your efforts will pay off in a more bottom line at harvest time.

This guide will teach you about cleaning business tax deductions and accounting tips so that you can run your business smoothly. Let’s get started!

Tax Deductions for Cleaning Businesses – Overview

By deducting eligible business expenses from revenue, tax deductions lessen your taxable income and, hence, your overall tax burden.

For one-person firms or small businesses, deductions can significantly impact self-employment taxes. While tax credits directly cut the amount of tax due, tax deductions decrease the amount of income liable to tax.

Individual taxpayers can itemise deductions to reduce their taxable income by utilising various available deductions (each with different eligibility rules), including:

These deductions include:

- Medical expenses

- Charitable contributions

- Mortgage interest

Alternatively, they can deduct a set amount known as the standard deduction. Owners of cleaning businesses can optimise their tax savings by being aware of everyday deductible items, like:

- Business-related supplies

- Travel

- Home office expenses

- Cleaning equipment and supplies

- Expenses when traveling between job sites.

Also, Read How To Get High-Paying Commercial Cleaning Contracts

Why are Tax Deductions Necessary for my Cleaning Business?

When you own the business, you must work on a strategy to reduce taxable income and improve the profit rates from the sales. This way, your business’s burden decreases, and you get more funds and investments, which results in a deduction from the business income the IRS can tax.

You can reduce your tax deduction by following these instructions:

- Boosting cash flow to put back into expanding your cleaning company

- Developing an awareness of your deductions will help you avoid overpaying.

- Over time, increased profitability is the result of effective tax administration.

Use these deductions and get more chances to minimise lose and maximise your financial well-being.

Also, Learn How to Start a Speciality Cleaning Business

Cleaning Business Tax Deductions and Accounting Tips

Learning about expenses and deductions helps cleaning businesses save money on taxes.

Know Deductible Business Expenses

You will learn that housekeepers’ and cleaners’ taxes are deductible. This covers office expenses, cleaning supplies and equipment, and business marketing charges. By being aware of these, you can increase your tax deductions.

The Role of Accountants in Claiming Deductions

Your cleaning company can maximise its deductions with the assistance of an accountant. They know their tax responsibilities and can determine all deductible expenses using the actual expenses technique, which lowers your tax liability.

Strategies for Business Tax Deductions

Use strategies such as deducting the expense of utilizing a personal phone for business purposes and functioning from a home office to reduce taxes.

By reducing your business income, these deductions can help you save money on Medicare and Social Security taxes. Always maintain accurate documents to back up your assertions.

Optimizing Tax Returns for Cleaning Business Owners

Optimize tax returns by following these strategies:

Maximizing Tax Benefits for Cleaning Products

You can deduct any cleaning supplies you use for work. This covers things like brooms, chemicals, and soaps. These costs are essential to your job. Keep a record of every purchase you make for your cleaning materials.

Tax-Saving Tips for Self-Employed Cleaners

Use your phone to attend phone calls, especially business phone calls. Also, make a claimation of deduction for car expenses.

You can find more deductions and reduce taxes by knowing what is typical and required for operating your firm.

Also, Read 5 Best CRM Software for Cleaning Businesses

Understanding Depreciation of Cleaning Equipment

Vacuum cleaners and other cleaning supplies may lose value over time. This tells us that the company instruments will get cheaper after some years. If you make your office at home, you can deduct some expenses based on the square footage used for your business.

This provides ou a chance of business deductions and also decreases your tax liability.

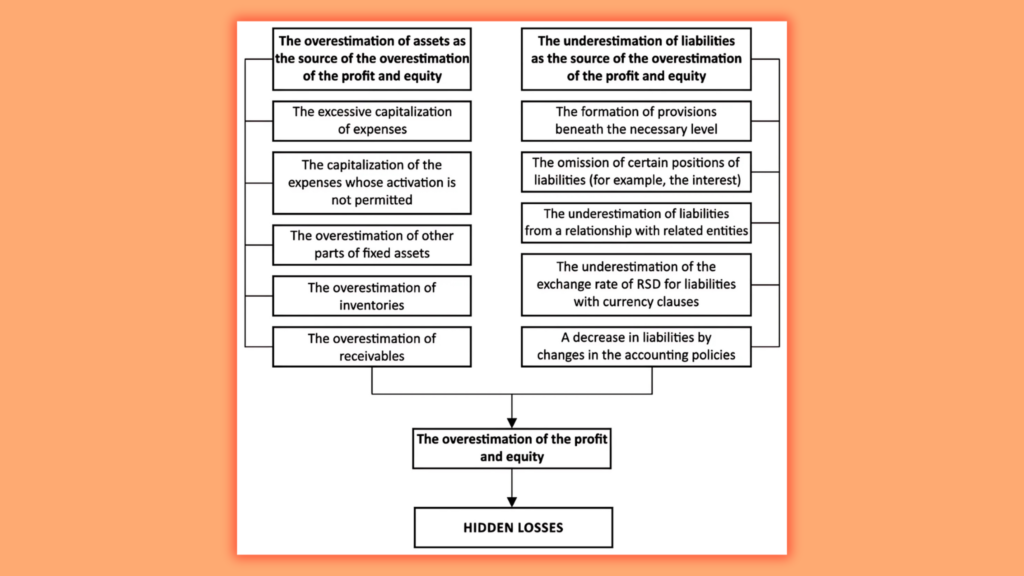

What are Some Common Mistakes to Avoid When Claiming Deductions?

IRS laws ask people to be cautious when claiming tax deductions because it is compulsory. Otherwise, you can meet errors like overestimating our spending money, which may cause the issue that you will not be able to keep accurate data and records. So, you must follow cleaning Business Tax Deductions and Accounting Tips.

Overestimating or Underestimating Expenses

Avoid making inaccurate claims; this can destroy your business. For instance, making a false claim about your business expense will result in audits and you will spend more money to resolve this issue.

Always keep a check and balance on what you have spent, why you have paid, and how much money you earn from that investment.

Mixing Personal and Business Expenses

Personal and business use expenses must be kept separate to prevent issues when filing taxes.

You can better understand your tax responsibilities and ensure that only company-related expenses are reported using a specialized business account for transactions.

Failing to Keep Proper Documentation

Deductions may be rejected during an audit without the appropriate paperwork, such as invoices and receipts. Keep thorough digital records of every expense to produce documentation if required.

Maintaining accurate records without adding additional chores to your workday is ensured when you deal with a professional bookkeeping firm.

Also, Read How to Upsell Cleaning Services to Existing Clients

Conclusion

Whether a newbie or an experienced businessman, you need cleaning business tax deductions and accounting tips. Because these are necessary to follow, you can’t run your business accurately without following them.

Without them, you may find some issues in gathering records of your spending, which can lead you to serious problems and eventually to a significant loss. If ou needs help, you can visit us to get further guidance.

FAQs

What is the cleaning formula?

Combine one gallon of warm water with half a cup of white vinegar, one cup of regular household ammonia, and one-fourth cup of baking soda. Use it like a commercial brand like Formula 409 after dispensing it in a spray bottle.

What is the charge for cleanliness?

2100 to 2400 for cleaning a vacant one-bedroom property. On the other hand, deep cleaning an inhabited one-bedroom home might cost anywhere from Rs. 1500.00 to Rs. 1700.00 at the lower end of the spectrum and between Rs. 2400 and Rs. 2900 at the top end.