Startup Business Pitch: Key Strategies for Success

When it comes to launching your startup, a business pitch is everything. It’s the moment that could make or break your chance at getting the investment you need. A strong startup business pitch doesn’t just explain your idea it tells a story. It should clearly show your vision, how you’re solving a real problem, and why your startup has the potential to grow.

Whether you’re preparing for your first pitch or refining your approach, knowing what to include in your startup pitch deck is critical. Investors want to see more than just a great idea they want evidence that there’s a real market opportunity, that you’re making progress, and that there’s a strong team behind the idea.

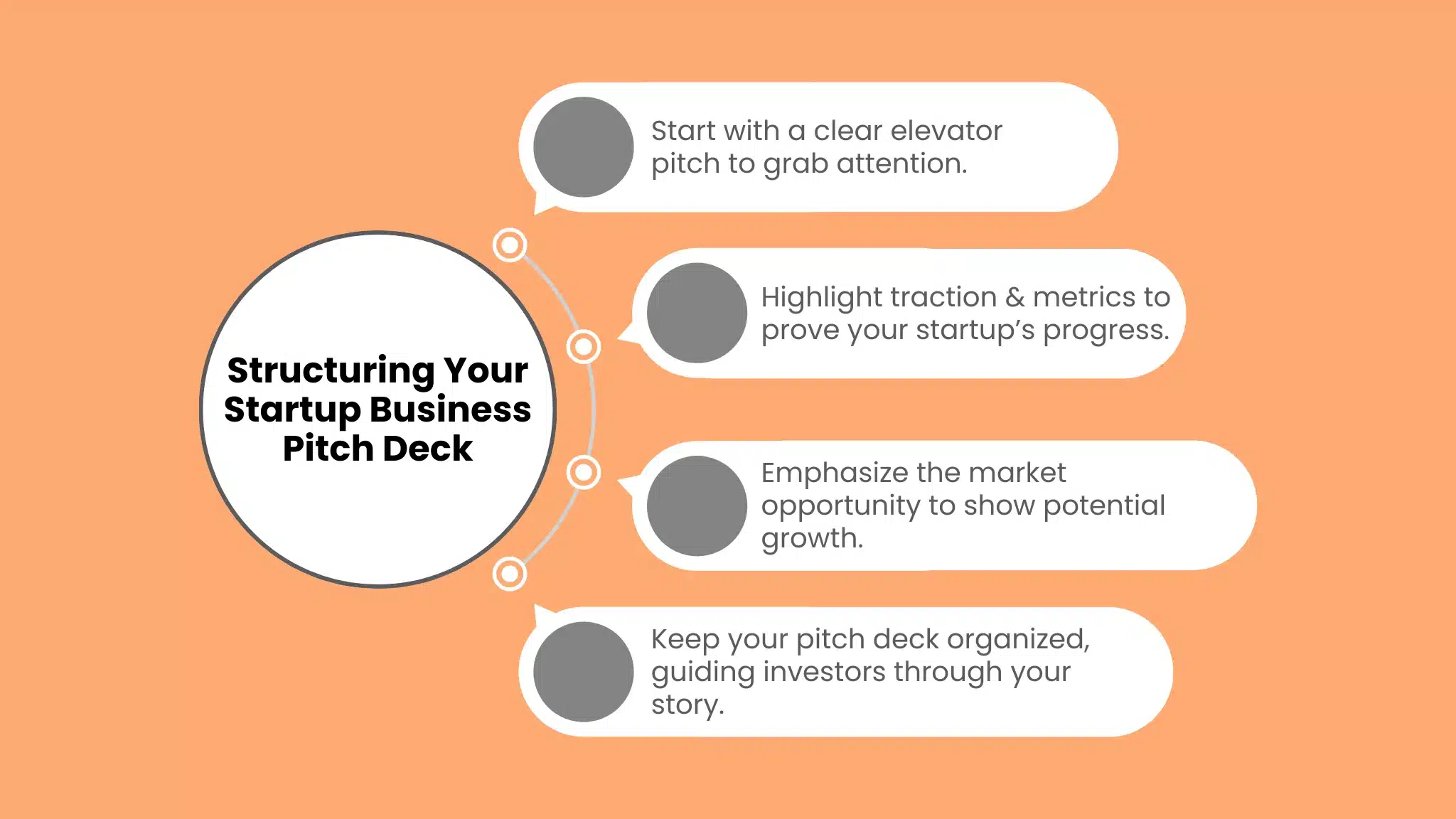

Structuring Your Startup Business Pitch Deck

Once you’ve got your story in place, the next step is to put it all together in a startup pitch deck that flows naturally. Think of your pitch deck as a roadmap, guiding investors through your story, from the problem you’re solving to the financial model for a startup. Keep it clear and straightforward, highlighting the key elements that investors care about most.

Start with a brief elevator pitch. This is your first chance to grab attention. You want it short, but powerful. In just a few sentences, explain what your startup does and why it matters. Keep it simple, but make sure it conveys your passion and your vision clearly.

Next, move into your traction & metrics. Investors don’t just want to hear about your idea—they want proof that it works. This could be early sales, user growth, or any other data that shows your business is gaining traction. ven if you are bootstrapping business startup operations, showing that your idea is resonating with users can make a big difference.

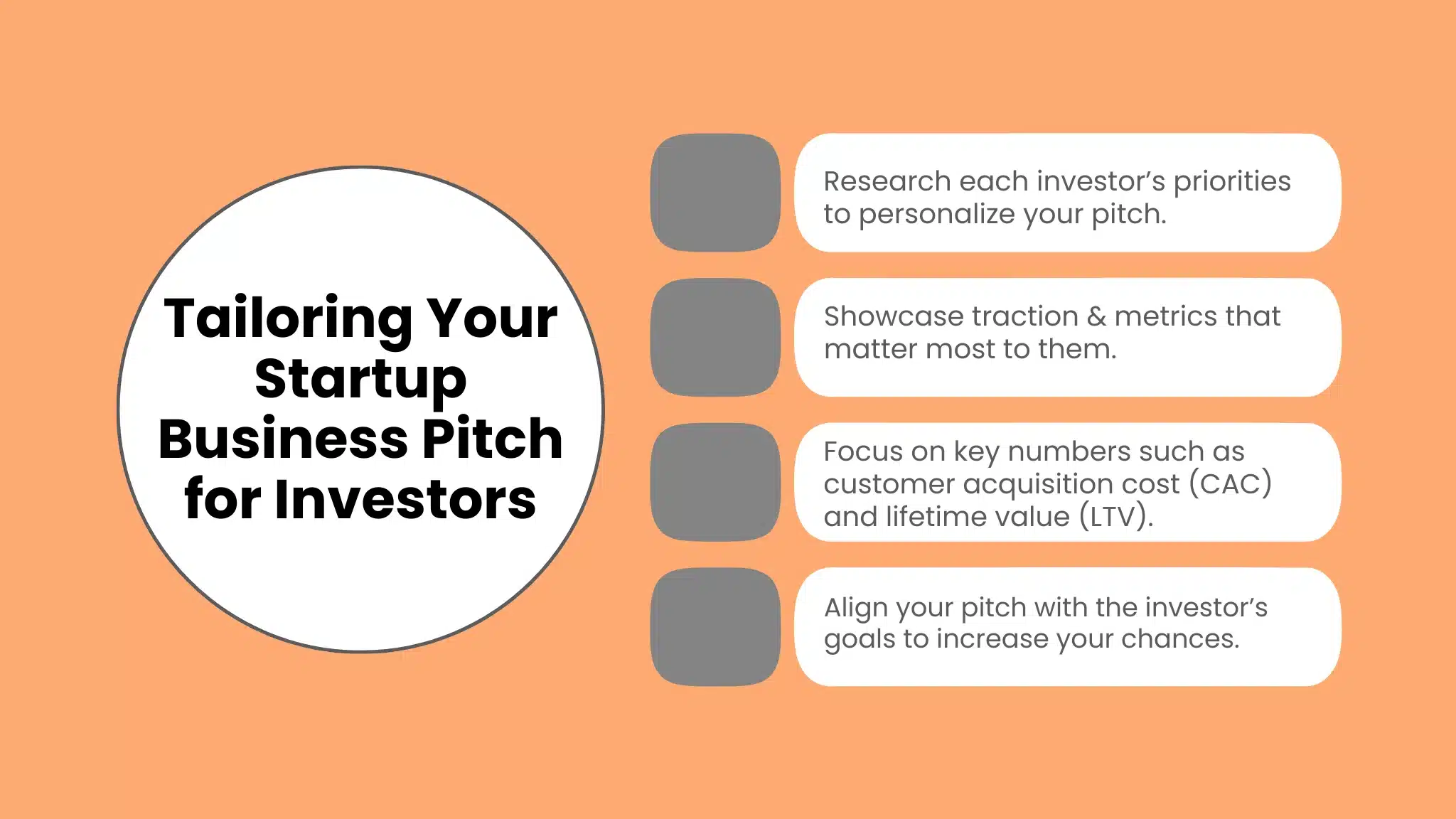

Tailoring Your Startup Business Pitch for Investors

No two investors are the same. That’s why tailoring your startup business pitch to fit the specific interests of the people you’re presenting to is crucial. Some investors care more about the market opportunity, while others are more focused on traction & metrics.

The key is understanding what matters most to them and making sure your pitch speaks directly to those priorities.

Know Your Investor’s Priorities

Before you pitch, take time to research the investor’s background and investment preferences. Some investors are more likely to back early-stage startups with high growth potential, while others prefer to see proven traction before committing. Tailoring your pitch to meet these expectations will help you stand out.

Focus on the Numbers That Matter

While your story is important, investors also want to see numbers. This is where your traction & metrics come in. Metrics like customer acquisition cost (CAC), lifetime value (LTV), and user engagement rates help investors quickly assess whether your business has the potential to scale.

Make sure these numbers are front and center, but avoid overwhelming investors with too much data.

Clarify Your Exit Strategy for Startup Business Pitch

Investors aren’t just funding you out of goodwill they want to know how they’ll eventually see a return. Be upfront about your fundraising pitch and your exit strategy. Whether you plan to exit through an acquisition, IPO, or another route, showing that you have a clear plan for how investors can profit will make them more confident in your business.

Perfecting Your Delivery

A great pitch deck is only part of the equation how you deliver it is just as important. Even if you’ve perfected your startup business pitch, the way you present it can make a huge difference in how it’s received. The key is to be confident, passionate, and clear in your delivery.

Master Your Elevator Pitch for Startup Business Pitch

Start with a strong elevator pitch. This is your chance to immediately capture the investor’s attention, so keep it concise and to the point. Avoid long-winded explanations just highlight the most important aspects of your startup and why it’s worth investing in.

Engage with Traction and Metrics

When you get into the traction & metrics portion, engage your audience with clear, impactful data. Don’t just list numbers show how these numbers prove that your startup has legs. Whether it’s the growth in your user base or improvements in key metrics like customer acquisition cost (CAC), use these figures to paint a picture of your startup’s potential.

Close with a Persuasive Fundraising Pitch

As you wrap up, make sure your fundraising pitch is clear and confident. Don’t leave investors guessing about how much you need or how you plan to use the funds. Explain exactly what you’re asking for and how the investment will help you achieve your next milestones.

Make sure they leave the pitch feeling like your startup is a solid investment opportunity.

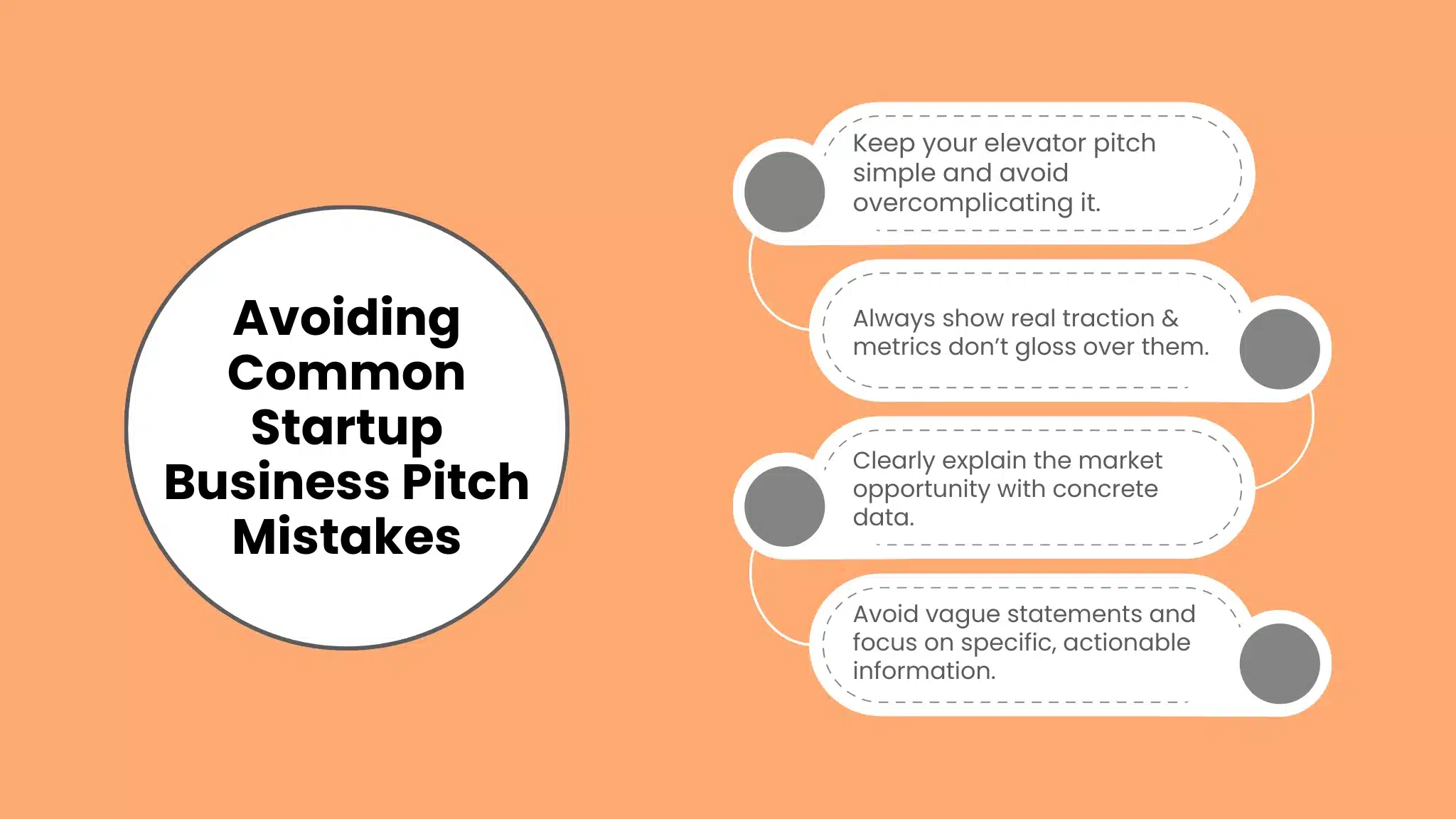

Avoiding Common Startup Business Pitch Mistakes

Even the best pitch can be derailed by avoidable mistakes. Here are some common pitfalls to watch out for:

Don’t Overcomplicate Your Elevator Pitch

Your elevator pitch should be simple and clear. Avoid overloading it with too many details. Investors don’t need to know every aspect of your business right away they just need to understand the problem you’re solving and why your solution matters.

Show Real Traction and Metrics

A big mistake is glossing over your traction and metrics. Investors need to see that your startup is gaining traction. If you’re still early, don’t worry focus on the growth you’ve achieved and any early signs of success. Whether it’s user growth, sales, or partnerships, make sure you’re showing proof of concept.

Clarify Your Market Opportunity

Finally, be sure to clearly explain the market opportunity. Investors want to know that your startup can grow in a large market. Avoid vague statements use data to demonstrate the size and growth potential of your target market.

Conclusion

Crafting the perfect startup business pitch is no easy task, but with the right structure and approach, it can set the foundation for securing the funding your startup needs to thrive. By focusing on the key elements like a clear elevator pitch, solid traction & metrics, and a compelling fundraising pitch you can demonstrate that your startup has real potential.

Remember, a successful pitch doesn’t just sell your business idea; instead, it shows investors that your startup has not only the vision but also the team and the metrics to back it up. With the right pitch, you’re, therefore, well on your way to impressing investors and taking your startup to the next level.

FAQs

1. What is the purpose of a startup business pitch?

A startup business pitch aims to convince investors of your startup’s potential, showcasing your business idea, market opportunity, and growth prospects to secure funding.

2. How long should an elevator pitch be?

An elevator pitch should be brief, ideally lasting 30 to 60 seconds, focusing on your startup’s mission, the problem it solves, and its unique value proposition.

3. What key metrics should be included in a pitch deck?

Key traction & metrics include customer acquisition costs (CAC), lifetime value (LTV), sales figures, user growth, and engagement rates essential data for investors.

4. How do I craft a winning fundraising pitch?

Your fundraising pitch should clearly state the amount of capital needed, how you plan to use the funds, and what investors can expect in return.