How to Build a Financial Model for Your Startup

Many startup founders just focus on building their product, landing customers, or securing funding rather than looking at spreadsheets all day.

But here’s the thing: without a solid financial model, you’re going to be in a dead end.

Imagine walking into an investor pitch, and they ask you:

“What’s your cash flow next year?” or “How will you scale profitably?”

If you fumble that answer, it’s game over. Your idea might be brilliant, but even the best pitches fall flat without numbers to back it up.

Financial modeling may seem complicated. And let’s be honest, not every founder comes from a finance background.

The good news is, that creating a financial model for a startup doesn’t have to be rocket science. It can be simple and even empowering when done right.

This guide will break it down step by step, without jargon or fluff. Just clear, actionable insights to help you:

- Understand your startup’s financial health.

- Project where your business is headed.

- Confidently pitch in front of investors.

Let’s get started:

What is a Financial Model for a Startup?

A financial model for a startup is a tool that gives you a way to understand and predict how your business is going to perform financially.

Think of it as a roadmap: instead of showing you how to get somewhere, it lays out how much you expect to make every month, how much you’ll spend, and ultimately, how much money you’ll leave with.

A startup will use a financial model to calculate how much money it’ll require upfront when the startup will break even or when it will start scaling.

Numbers mean something, but numbers aren’t everything, it’s about making intelligent decisions, using real estimates.

Finally, financial models are a favorite of investors because they provide them some comfort that you have a proper business plan to grow.

Why does your Startup Need a Financial Model?

A financial model for your startup is all about ensuring your business has a solid plan that is necessary to survive and succeed.

Running a startup is fast and uncertain until you know the numbers, there’s flying blind.

A solid financial model allows you to calculate your revenues, costs, break-even points, and cash flow to make more intelligent, fact-based decisions.

Venture capitalists doubtlessly love GAAPs as much as they do the newfound freedom of crunching the numbers to make reasonable predictions; most won’t even look at your startup if you can’t show reasonable financial projections proving your growth potential.

That’s why real-time tools such as Quickbooks and Xero help businesses track their finances and reduce cash flow issues by up to 50% (Intuit).

Startups must adapt to market shifts, like the increase in costs or economic uncertainty, something that is more important than ever in today’s economy and financial modeling is also useful for helping adapt to these marketplace changes.

However, in the end, it’s not just a nice to have, it’s a need for you to scale your business and avoid preventable pitfalls.

Types of Financial Models for Startups

These are the most common financial models for startups:

- Discount cash flow (DCF) model. It is an application that calculates a company’s present value using discounted cash flow forecasting.

- Three-statement model. Project a company’s income statement, balance sheet, and cash flow statement.

- Input-Output (IPO) model. It explains what a business needs to turn its input into its output, and what it is required to do to produce that output.

- Consolidation model. It aggregates the financial results of different businesses into one.

- Budget model. It is used to allocate resources according to business objectives, strategic initiatives, and business needs.

- Buyout model. Usually implemented to evaluate the acquisition of a company financed via debt.

What Are The Key Components of a Financial Model for a Startup?

Many components go into making a financial model for a startup.

Don’t forget, that the more precise and comprehensive the data you input into the model, the more accurate and rewarding the projections will be.

- Estimates of future sales on a market and historical data analysis.

- Cost Structures can break down your costs into fixed and variable, so you can easily understand how scaling your business does or does not impact your costs.

- The Cash Flow Analysis monitors liquidity and cash reserves to keep operational stability.

- Time-to-time assessment of financial health from income, expenses, and net profits makes of Profit and Loss Statement.

- Break-even Analysis measures the point at total revenues equal total costs

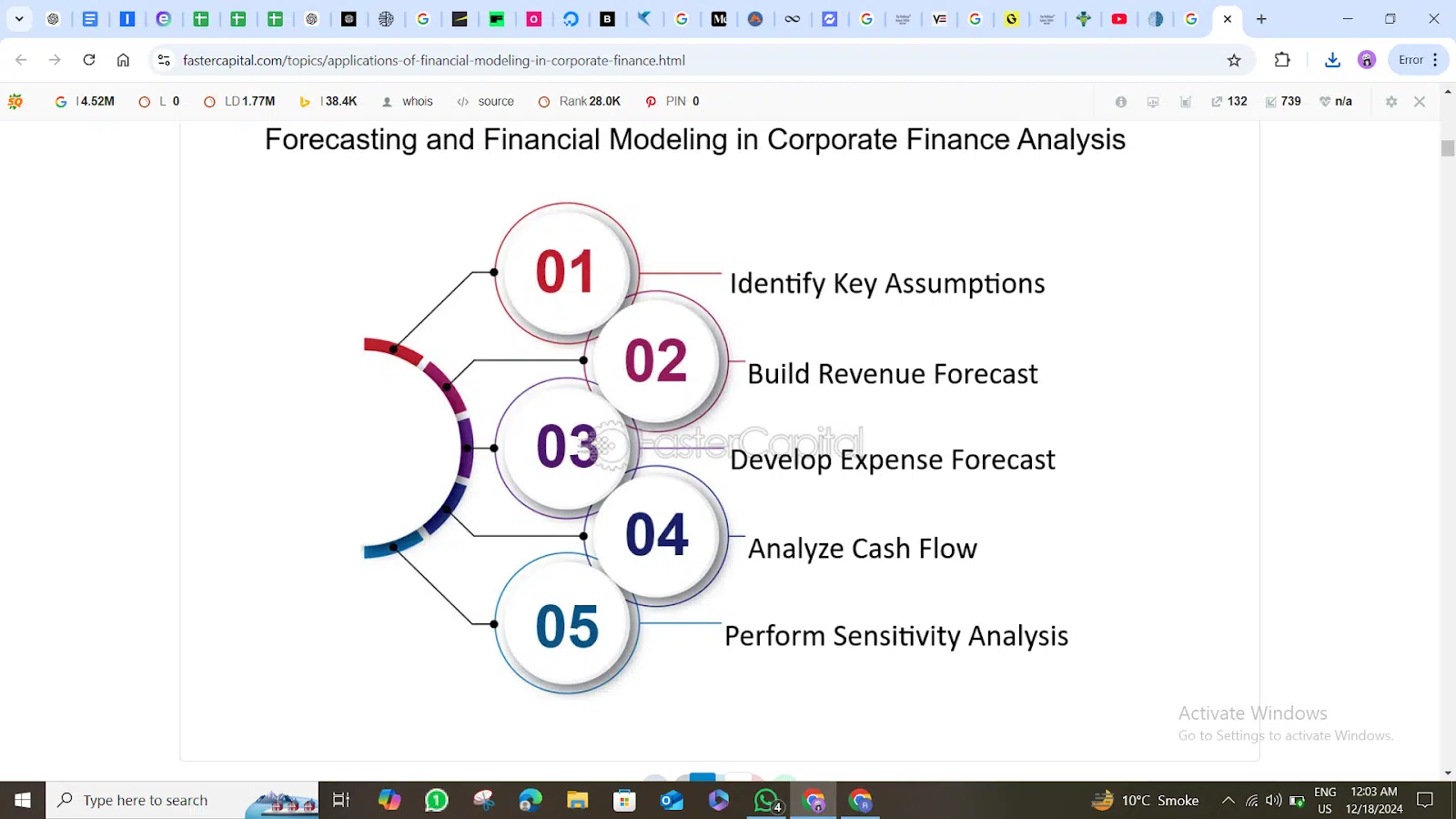

How to Create a Financial Model for Your Startup?

Step 1: Describe the Purpose of Your Financial Model.

Before diving into building your financial model, ask yourself:

- What makes me want to build this financial model?

- Are you trying to attract investors or get loans?

- To plan business growth?

- To manage cash flow and Operational budgets?

- Who is the audience?

The level of detail your model requires is dependent on your purpose.

For example, investors might want a 5-year forecast with metrics such as break-even analysis, whereas internal teams might only need some kind of cash flow outlook.

Step 2: Get Important Business Info

First of all, you need to know what business model your startup has and how it finances itself. Here are the key components to gather:

Revenue Streams:

- What does your business make money on?

- e-commerce selling products (e.g.)

- Subscriptions (e.g., SaaS)

- Services (e.g., consulting)

Pricing and Sales Strategy:

- What figure will you tag on your product/service?

- What do you expect of customers or sales?

Cost Structure:

- Fixed costs: (e.g, software tools like rent, salaries)

- Variable costs: (raw materials, commission)

Funding Needs:

What amount of money do you need to run the business?

Growth Projections:

Customer acquisition rates and revenue per year that you expected to achieve.

Step 3: Select the Tool to Build the Financial Model.

- Spreadsheet Software: The most popular ways to make financial models are with Excel or Google Sheets. These are a better endpoint and are used a lot.

- Financial Model Software: If you’re not keen on that, you can explore templates or software like Causal, LivePlan, or Jirav to walk you through it.

Step 4: Build the Revenue Forecast

Revenue forecasting is a critical part of the financial model, as it predicts the money your business will generate. Follow these steps to build it:

- Identify Revenue Streams: Separate each stream of income, such as product sales, subscriptions, or services.

- Define Assumptions: Outline key assumptions for:

- Price per Unit: The price you will charge for each product, service, or subscription.

- Units Sold or Customers Acquired: The expected monthly or quarterly sales.

- Growth Rate: An estimated percentage increase in sales over time (e.g., 10% monthly growth).

- Calculate Revenue: Multiply the price by the number of units sold.

Example Calculation:

If you sell a product for $20 and project 1,000 units sold in Month 1 with a 10% monthly growth rate:

- 1st Month: 1,000 units x $20 = $20,000

- 2nd Month: 1,100 units x $20 = $22,000

- 3rd Month: 1,210 units x $20 = $24,200

Step 5: Estimate Your Costs

To understand your business’s profitability, you need to know how to accurately estimate costs. Costs can be divided into two main categories:

- Cost of Goods Sold (COGS): These relate to direct costs incurred whilst generating or delivering what you are selling.

Examples for Products: The costs of manufacturing, packaging and shipping.

Examples of SaaS: Developer contracts or server hosting fees.

COGS Example: When you produce each unit for $10 and sell a total of 1,000 units then your total COG is a figure of $10,000.

- Operating Expenses (OPEX): These are ongoing costs that the business needs to run. Key categories include:

Salaries and Wages: Employee, contractor, and founder payments.

Marketing and Advertising: SEO, Ad campaigns, or Social media promotions.

Office Costs: Rent, utility, office supplies.

Software Subscriptions: Such items as CRMs, and accounting software.

Legal Costs: Legal consultations, or accounting fees courtesy of a professional service.

List each category, and estimate its monthly or annual cost to ensure that total expenses are somewhere near correct.

Step 6: Build the Profit & Loss Statement (P&L)

The Profit & Loss (P&L) statement, also known as the income statement, provides an overview of your revenue, costs, and profitability. Use this formula:

Revenue – (COGS + Operating Expenses) = Profit (or Loss).

Sample P&L Structure:

| Month | Revenue | COGS | Gross Profit | OPEX | Net Profit |

| Month 1 | $20,000 | $10,000 | $10,000 | $5,000 | $5,000 |

| Month 2 | $22,000 | $11,000 | $11,000 | $5,000 | $6,000 |

- Gross Profit: Revenue minus COGS.

- Net Profit: Gross Profit minus Operating Expenses.

Step 7: Add Cash Flow Projections

Cash flow projections help by tracking the inflow and outflow of cash to manage liquidity.

- Cash Inflows: Loans, investor funding, and revenue.

- Cash Outflows: Loan repayments, operating expenses, and tax payments.

Formula: Cash Balance Opening + CashFlows in – CashOutflows = Cash Balance Closing.

The cash shortage, the funding needed, and the operational runway are all identified in this projection.

Step 8: Conduct a Break-Even Analysis

Break-even analysis finds the point where revenue is equal to total costs – it’s neither profit nor loss.

Formula: Break-even point is = Fixed Costs ÷ Contribution margin (price – Variable costs).

Example:

- Fixed Costs = $10,000/month

- Price per Unit = $50

- Variable Cost per Unit = $30

- Contribution Margin = $20

- Break even units = $10,000 ÷ $20 = 500 units.

Step 9: Test Scenarios (Sensitivity Analysis)

Test your financial model with multiple scenarios to assess its resilience:

- Best Case: High sales, low costs.

- Worst case: Low sales, high costs.

It prepares you for any uncertainties and adds confidence to investors.

Step 10: Summarize Key Metrics

Summarize critical metrics to ensure clarity and focus:

- Revenue Projections

- Profit Margins: Gross and Net Margins

- Break-Even Point

- Burn Rate: Monthly cash usage

- Runway: How much current cash will last getting them through.

- Funding Needs: The total amount needed to be invested and for what?

Graphs and charts can be used to look at data visually to help make data simple for the stakeholders.

Step 11: Keep Updating the Model

A financial model is a live document. Make regular updates to it, from actual sales, actual expenditures, and actual growth rates of your business as they are today.

Refine assumptions and increase accuracy by comparing projections to real results and maintaining relevance of the model; making it only an actionable one.

Benefits of the Right Financial Model

1: Deep understanding of business.

Companies who design financial model for a startup can then understand the business and what factors affect it better than their rivals and are thus better prepared for any uncertain situation that may come.

2:Timely Performance Review

Variance analysis is done by financial models which compare the real result of the business with the budget. A periodic performance review helps to get feedback on the performance of the business operations.

The advanced financial models aid businesses in making changes in their operations, relying upon the variance analysis, to raise the overall profit.

3:Set the Funding Strategy

Financial models make clear when cash is coming and going out. This will allow a business to know the net cash flow that they need to run their business.

The next question is: what are you going to fund this new project with (debt vs equity)?

This can be understood by working on these financial models to know the cash flow position resulting in meeting the interest expense and the payment of loans.

This will help decide whether the business can take debt and the level at which the business will have equity finance.

4: Valuation of Business

Financial models can be used by companies to understand their worth. A financial model aids in projecting the free cash flows that are likely to be generated for a business at a distinct time en route to the fair value of a business.

When you start down the path of making a restructuring, whether it’s selling the stake to outsider parties or investors, this becomes useful.

5: Risk Minimization

A financial model suggests the financial impact of a certain activity, it helps to minimize the overall risk in a business.

For instance, if a business wants to enter a new market, a financial model will show how expensive such an entrance would be, how better the marketing should be, and how price changes are needed to affect the business.

6 – Shows Quick Outputs.

For some financial questions, it can take days, and for others, months, before a business begins to get answers, and certainly months before it knows the consequences of a decision.

On the contrary, financial models give speedy results and hence, quick decision-making. In this way, financial models are very useful for businesses.

That’s all! You can also check out Top 10 Healthy Foods Companies in the United States and 10 Fintech Funded Startups-How to Get Your?.

Final Thoughts

In the following piece, we explained every single detail regarding the financial model for a startup. Making one for your startup needs proper planning and the right strategies as we already discussed.

Besides this, if there’s anything you wanna discuss regarding the financial model for your business, Reliable Startup is here to sort out your business’ worries with our expert guidance.

Contact us to get the best advice on creating a financial model!

FAQs

How do I forecast revenue for my startup if I don’t have historical data?

For startups without historical data, revenue forecasting can depend on market research, industry benchmarks, customer acquisition assumptions, pricing strategies, and a reasonable estimate of your target market size.

What common mistakes should I avoid when building a financial model?

Common mistakes include over-optimistic revenue projections, underestimating expenses, neglecting cash flow forecasting, not continually updating their assumptions, and ignoring sensitivity analysis by not considering ‘best case’ vs ‘worst case’ scenarios.

How can I ensure my financial model is investor-friendly?

To make your financial model investor-friendly, focus on accuracy, simplicity, and clarity. It should clearly state assumptions, honest projections, key metric summary in the results table, and visuals such as charts or graphs for the probability of growth and financial health.

Meanwhile, you can also check out Top 30 Education and EdTech Venture Capital Firms and 21 Corporate E-Learning Solutions for Businesses (2025).