Top 10 Fintech Startups Europe that are on the rise – A Complete Guide

Many websites comprehensively list the top Fintech Startups Europe in 2025. But do you learn anything from them?

Tbh, Nothing you learn from them. You just say wow! And you don’t know how to start a fintech company for yourself.

But don’t worry.

In this blog, you will learn everything about the top fintech companies in Europe and also the tips to start your own.

So keep reading.

Top 10 Fintech Startups Europe in 2025

Have a look at 10 exciting fintech startups in Europe. Each one is growing fast and making an impact in the industry.

Let’s check out their key stats!

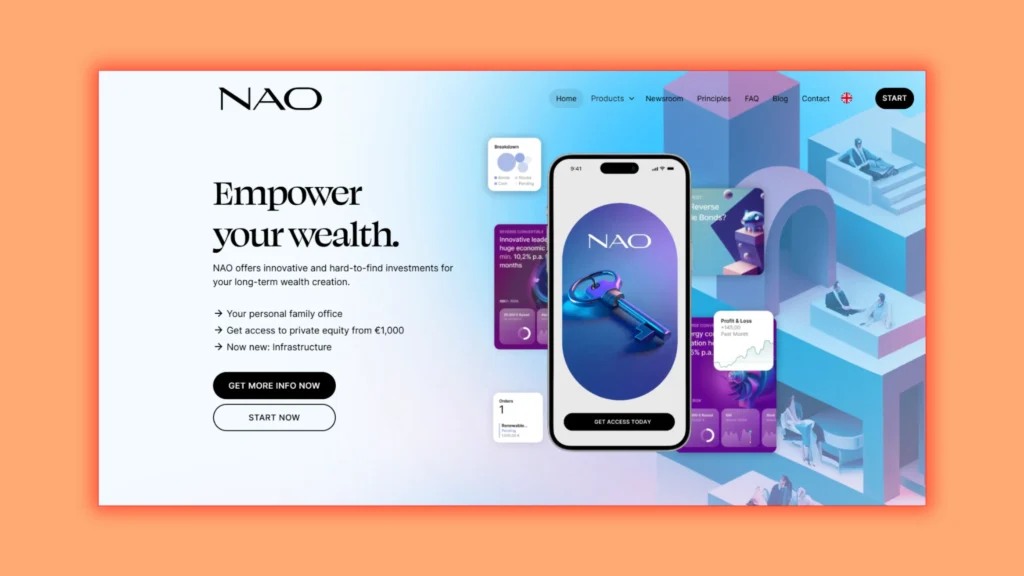

1. NAO

First on our list of fintech startups Europe is NAO. A fintech startup from Berlin. They’re opening up private equity and venture capital opportunities to everyday investors.

What’s exciting? They’ve made it easier with lower investment thresholds—no need for a massive capital outlay.

Valuation : Between €7 million and €11 million.

Funding : Raised €1.6 million in pre-seed funding from Zeitgeist X Ventures.

Products:

- Co-investment opportunities

- Private equity investments

- Reverse convertible bonds

Global Reach

While based in Germany, they plan to expand across Europe.

Now, everyday people have access to markets they couldn’t reach before. Exciting times are ahead for NAO!

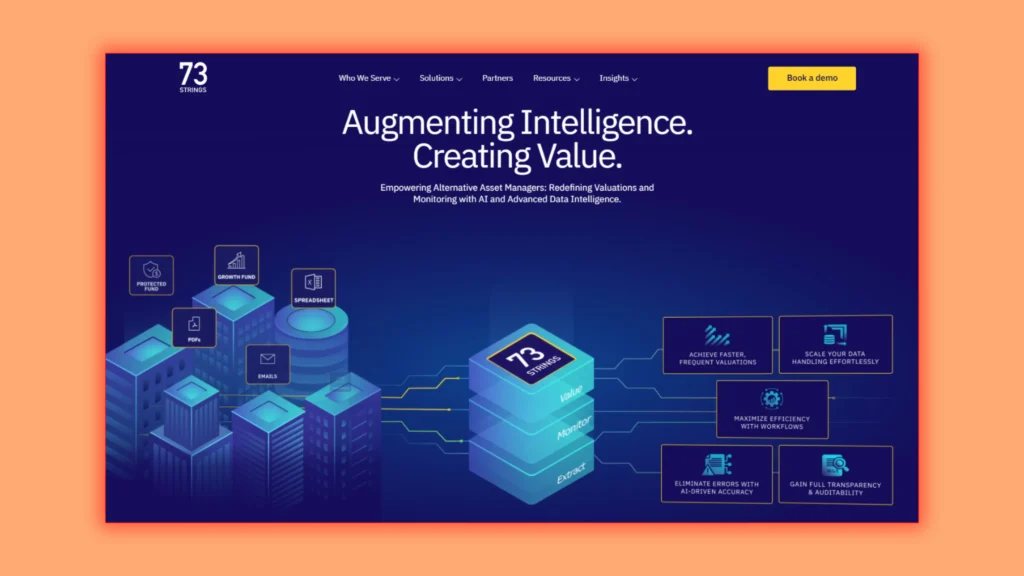

2. 73 Strings

Next on our list of fintech startups Europe is 73 Strings. It’s a fintech startup from Paris that is redefining alternative investments.

They’re all about simplifying how illiquid assets are

- Valued

- Monitored

- Traded

Valuation : Estimated at $50 million as of 2024.

Funding : Secured $10 million in Series A funding.

What They Offer

- Qubit X: Simplifies asset valuation.

- Graviton X: AI-driven tools for data collection and monitoring.

Global Reach

They operate internationally, with teams in:

- Paris

- London

- Amsterdam

- Toronto

- Bengaluru

3. Casavo

Casavo is based in Milan, Italy. It is a real estate platform that uses technology to simplify:

- buying

- selling

Valuation : Around $796.98 million (2024)

Funding : The total funding raised is around $410 million. There is a raise of €20 million.

Key Services:

- Instant cash offers via the iBuyer model

- Automated property valuations through EVA

- Renovation and interior design services

Market Presence

Operates in:

- Italy

- Spain

- Portugal

4. lemon.markets Overview

lemon.markets is a fintech based in Berlin. It offers a simple Brokerage-as-a-Service API.

Fintechs, banks, and wealth managers can easily integrate investment tools with it.

Valuation : $83 million after July 2024 funding.

Funding : Total €28 million; €12 million raised in the latest round.

Products

- Brokerage infrastructure for stocks, ETFs, and funds

- API to integrate investment products

- Financial education tools (e.g., beatvest app)

5. Swan

Swan is a Paris-based fintech start-up. It offers Banking-as-a-Service (BaaS) solutions. It was founded in 2019.

It helps businesses embed banking features using APIs, such as

- Accounts

- Payments

- Cards

Funding : €58 million raised, including a €37 million Series B (2024).

Products

- Banking APIs

- Card Issuance

- Compliance Tools

- Fraud Management Tools

6. Paynovate

The sixth one on our list is Paynovate. It’s a Belgian e-money institution offering digital payment solutions.

They focus on B2B transactions across the EEA, providing:

- Payment Issuing

- Acquiring Services

- IBAN Accounts

By the way, they haven’t shared their total valuation publicly. But the following numbers can help estimate their growth.

Transaction Volume

Over €200 million monthly

Growth : Expanded to the UK and Paris

7. Brite

Brite Payments is a Swedish fintech founded in 2019. It offers real-time bank payments using open banking technology.

It offers:

- Instant Payments: Real-time transactions.

- No Card Info: Payment without credit cards.

- Wide Reach: Active in 26 European markets.

- Low Costs: Reduced fees for merchants.

Funding

Raised $60M in recent years.

8. Mellifera

Mellifera is a fintech company based in St. Julian’s, Malta. It was founded in 2020.

The company specializes in IT solutions for:

- Payment processing

- Anti-fraud technologies

Growth : Increased employees by 783% from 6 to 53.

Core Focus : Offers IT solutions to PSPs, EMIs, and neo-banks.

9. Vertice

The seventh on our list is Vertice It’s a UK-based fintech providing a SaaS and cloud spend management platform.

Total Funding : $51 million, including a $25 million Series B round in January 2024.

Valuation : Estimated in the hundreds of millions.

10. Embat

The last one is Embat. A fintech startup in Madrid. It focuses on corporate finance management for medium to large businesses.

Valuation : $77 million

Funding : Raised Series A, €70 million valuation.

Key Services:

- Treasury Management: Automates cash flow and debt tracking.

- Financial Forecasting: Predicts financial outcomes.

- Collaborative Tools: Enhances team efficiency.

Tips for Starting A Fintech Company in Europe

Such incredible growth makes one want to start his fintech venture, doesn’t it?

Well, we get it!

That’s why we’ve put together some foolproof tips for you.

1. Understand Regulations

Our first advice to you is to understand the rules like the EU’s PSD2. They can be tricky.

So, it’s best to get a solid grip on them early. Work with a legal advisor to guide you.

Knowing these rules well from the start will make things much easier down the road.

2. Choose the Right Location

Think carefully about where to set up your business. Go for the country that offers supportive environments for fintech startups.

- Estonia

- Lithuania

- Malta

3. Define Your Niche

The next big thing for any startup’s success is choosing the right niche. Find a specific problem or gap in the market you can solve.

Choose a niche that can help you stand out from the competition. It’s the best way to attract a dedicated customer base.

4. Build a Strong Team

Surround yourself with talented individuals who have experience in both

- Finance

- Technology

A well-rounded team can bring multiple perspectives and skills to your startup.

5. Network Actively

Connect with other fintech startups and industry experts. These interactions can give you valuable insights into the market and its latest trends.

6. Focus on Customer Experience

Prioritize delivering exceptional service to your users. Happy customers surely become loyal advocates later.

Conclusion

Europe’s fintech industry is growing fast. Startups like NAO are opening private equity to everyone. Brite is leading the way with instant payments.

If you want to start your own fintech, understand the rules, pick the right country, focus on a niche, and build a strong team.

Networking is key. Keep customers happy, and you’ll succeed. Stay curious, and you could be the next big thing in fintech!