10 Fintech Funded Startups-How to Get Your?

Your financial idea is excellent, but let’s be honest: getting funding is like climbing Mount Everest. You’re not the only founder who feels this way.

It takes a lot of work to get investors. They seek new ideas, the ability to grow, and a track record of delivering results. But you can’t prove anything when you’re just beginning, right?

And there’s also the competition. Every new business seems to offer “revolutionary” solutions. You might wonder, “How can I stand out in this sea of pitches?”

But the good news is that you can escape this cycle. It starts with being precise. Be mindful of your uniqueness, customers’ challenges, and growth potential.

Then, make your pitch simple to understand. Use simple words to impress them. Prove how your idea improves people’s lives and how investing in you benefits them.

The best part is that the right buyers aren’t just giving you money. They are mentoring you, trusting your ideas, and providing you with connections. You’ll be glad you waited for them when you find them.

So, let’s dive in for more information about Fintech Funded Starups and how they got them for their business.

What is Fintech Startup Funding?

Money is required to develop your idea, assemble talented people for your company, and expand your business.

Fintech startup funding helps you realize your financial technology idea. It’s like fuel for your vehicle; you can’t progress without it.

When starting your fintech company, you will require capital to develop your product, assemble a staff, and grow your company. People who believe in your idea give you this money.

You may get this money from venture capitalists, angel financiers, or the public through the sale of securities in your firm through crowdfunding arrangements.

They want finance companies like yours to solve significant challenges.

Not all fundraising is about money. It’s about finding people who support you and your idea.

So, if you have an essential fintech idea, startup funding will help you realize it.

What Are Fintech Venture Funds?

Fintech venture funds invest money in fintech startups and offer assistance to new companies to ensure their proper functioning.

These funds could be valuable if you’re working on something exciting in payments, loans, or digital banking.

They don’t only offer money; they also provide coaching, industry connections, and skills to help you advance.

Maybe you’re wondering, “Why would they put money into me?” They are actively looking for high-return startups, and your idea might be the next.

If you think about it, fintech startup funds are more than money. They’re fintech market partners who help you succeed.

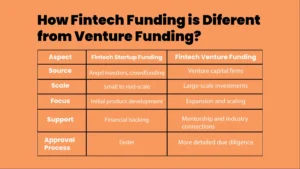

Differences Between Fintech Startup Funding vs Fintech Venture Funding

10 Fintech Funded Startups and What They Do

1. Ant Group (China)

- Funding Source: SoftBank Vision Fund, Primavera Capital Group, and sovereign funds.

- Details: International investors provided a lot of support before its IPO.

Founded in 2004, Ant Group, formerly Alipay, has emerged as a leading player in the fintech industry.

The company has a single primary product, Alipay, through which over one billion citizens worldwide use their mobile devices to pay for products and services, merchants, bills, and transactions.

In addition, the company and MYBank provide small business loans; Ant Fortune provides wealth management services.

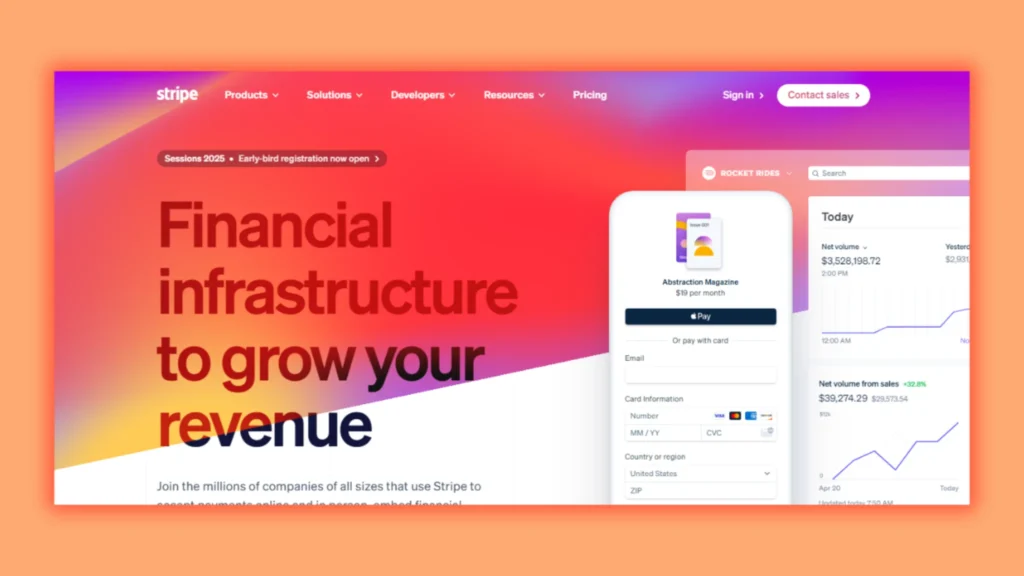

2. Stripe (United States)

- Funding Source: Berylls’s U.S.-based venture capital firms include Sequoia Capital, Andreessen Horowitz, Tiger Global, and General Catalyst.

- Details: Raised capital from leading VC firms from around the world.

Two brothers, Patrick and John Collinson, founded Stripe in 2010.

It supports the enablement of online payments and checkout experiences within the organizations.

These startups began with a simple idea to address significant issues—business loans.

Stripe has over 135 currencies, global clients, and $95 billion in funding in 2021.

3. Klarna (Sweden)

- Funding Source: Silver Lake, SoftBank, Sequoia Capital, institutional investors.

- Details: Was able to secure funding from VCs who focus on firms in e-commerce markets and consumer financing sectors.

Klarna established itself in 2005. With “buy now, pay later,” customers can shop and reschedule payments without interest.

This service is helpful for youth seeking something other than credit card debt.

Klarna also has elements associated with product search, navigation of shopping lists, reviews, and ratings.

Klarna has over 250,000 sellers in 20 countries. The company is worth $45 billion after funding.

4. Square (United States)

- Funding Source: Automobile public market the firm went public in 2015), Khosla venture and other private equity funds.

- Details: Originally financed by venture capitalists before getting listed.

Twitter founder Jack Dorsey launched Square Company in 2009.

It targets credit card readers and other mobile-based payments.

The merchant can quickly request the processing of card payments and various services such as processing, loans, and buying cryptocurrencies.

The company has already garnered significant investment, estimated at over $80 billion.

Square also designs, implements, and sells hardware and software solutions for the point of sale and business intelligence.

5. Robinhood (United States)

- Funding Source: DST Global, Sequoia Capital, and Andreessen Horowitz.

- Details: Significant funds were used from VCs and private equity firms.

Robinhood enables zero-commission investing in stocks, ETFs, options, and cryptocurrencies since 2013.

Companies use mobile apps and information materials to reach start-ups and young investors.

It has also entered cash management and cryptocurrency trading and raised over $5 billion in funding.

Robinhood is worth $30 billion, but the app has had regulatory issues.

6. SoFi (United States)

- Funding Source: Softbank, the consortium that includes Silver Lake Partners and Qatar Investment Authority.

- Details: Investment by world investors and venture capital alone.

Laurence founded SoFi in 2011. It started with student loan refinancing for your purpose and has since expanded into personal loans, mortgages, investment technologies, and banking.

It provides value by promoting community, financial literacy, job assistance, and member perks.

SoFi’s market capitalization is over $12 billion, and it has attracted more than $3 billion in funding.

7. Chime (United States)

- Funding Source: Sequoia Capital, SoftBank, and General Atlantic.

- Details: It captured attention because of its disruptive online banking strategy.

Chime offers online and mobile banking since 2013. It proposes free checking and savings.

It offers early deposits on direct deposits and the feature to limit spending, which will interest young individuals looking for honest cooperation with banks.

Chime has $2.2 billion of capital and is now a $25 billion digital bank—the largest in the U.S.

8. Revolut (United Kingdom)

- Funding Source: DST Global, Index Ventures, SoftBank and TCV.

- Details: Endeavored by venture capitalists and institutional investors interested in fintech.

Bank, international money transfer, and cryptocurrency exchange app Revolut launched in 2015.

It is famous for providing instant notifications, virtual cards, and pay features like travel insurance.

Revolut is an international app that allows multiple currency accounts, perfect for frequent travellers. It has attracted over $900 million and has a monopoly of $33 billion.

9. Nubank (Brazil)

- Funding Source: Tencent, DST Global, Sequoia Capital and QED Investors.

- Details: Popular among the international VCs because of its prospects in the Latin American market.

The 2013-founded Nubank offers free credit cards and loan accounts to challenge Brazil’s centralized banking system.

It has a decent app with basic budgeting options and instant customer care services.

Nubank has expanded fast and become one of Latin America’s most loved fintech firms. It has attracted over $2 billion in funds and is now worth $30 billion.

10. Affirm (United States)

- Funding Source: Lightspeed Venture Partners, Singapore’s sovereign wealth fund/GIC, and Andreessen Horowitz.

- Details: Acquired funding from the top tier VCs focusing on the consumer finance domain.

Starting in 2012, Affirm mainly offers ‘Buy Now, Pay Later’ facilities, where users can make a one-time purchase by breaking it into parts without additional charges.

Due to the clear and easy-to-understand lending, Affirm is famous for online buying.

These startups began with a simple idea to address significant issues.

They showed that a niche market company that powerfully meets customer needs can get funding to grow and succeed.

It may be your startup’s turn next!

How to Get Funding for Fintech?

However, you can get one by following the below tips:

Identify Your Unique Value

Describe how your solution will meet consumer needs and what makes it unique.

Develop a Solid Business Plan

Include your target audience, revenue streams, and how your business will grow.

Create an engaging pitch deck

Make it brief and graphic, and include dos and don’ts and essential issues such as growth prospects.

Reach the Right Investors

Reach out to a group of fintech-focused investors during a meeting or forum.

Practice Your Pitch

Be confident and passionate when presenting your idea and explaining how you will implement it.

How Does Fintech Startup Funding Work?

Let’s check how it works.

- Fund your product or concept to show your idea.

- Show investors your fintech solution’s ingenuity and market potential.

- Show user traction, income, or partnerships to scale operations.

- Use this financing to develop your team, penetrate new markets, and improve your services.

- Investors want scalable solutions and a clear route to profitability.

- Besides money, investors may offer mentorship, business connections, and strategic counsel.

With preparation and effort, you can complete the step-by-step process. Show investors why you can succeed—they’re betting on you!

How Do You Get Funding for Fintech?

But the question is how to get one for your fintech business idea. So simple. The following steps to land a high-paying investor and start earning from your startup:

Define Your Unique Value

Therefore, the critical question is: how your fintech solution is unique and how you can satisfy a particular market demand.

Create a Solid Business Plan

Explain where your target market is, how much money you can make, and how quickly.

Build an Engaging Pitch Deck

Ensure it is concise and picture-based to highlight your solution and the possibilities of the firm’s development.

Find the Right Investors

You should engage fintech investors with commonly held beliefs in investors through crowdfunding.

Perfect Your Pitch

Engage in a rehearsal in which you demonstrate confidence and passion while answering the main questions about the startup.

Remember that funding goes beyond money. It’s about finding individuals willing to invest in your fintech and witness its growth. You’ve got this!

Cost to Start a Fintech Company?

Consider Your Product Type

The base essential model of a fintech app costs as low as $50,000, whereas adding an AI or a blockchain solution will cost over $200,000.

Development Budget

To achieve a compliant and friendly product, funding developers, designers, and testers becomes critical. The complexity of the project and the work team’s exposure to project development expenses are significant factors.

Fund Licensing

Financial regulations use licenses that cost between $20000 and $100,000 based on the region needed.

Infrastructure

The characteristics necessary for the organization are hosting, servers, and data storage. The price of cloud-based solutions ranges from $5,000 to $50,000 US dollars per year, depending on the usage and need for scalability.

Budget for marketing

Based on the total strategic plan, advertising, branding, and promotions can quickly top $10,000 in any market or target market group.

Expect Legal Fees

Legal work, such as preparing contracts, conducting compliance checks, and protecting IP, may range between $5,000 and $20,000.

Team costs

Depending on the team size and experience level, one significant regular cost will be the hiring or contracting of development, marketing, and operations experts.

Conclusion

Starting a fintech startup is thrilling but challenging. Bringing your creative concept to life requires planning, dedication, and assistance.

There are financial options everywhere if you know where to look. With clear goals, you can start small with seed investment or go big with fintech startup funding.

But how can you get this funding from others?

Investors want to see what unique solution your startup can bring to the market. Show them your drive, vision, and execution. A compelling pitch and a well-crafted business strategy can help you close a high-paying investor.

However, when you get one, slowly construct your product, test the market, and grow. Every successful finance business begins where you are. So dont worry; just start and ask for help.

The trip may seem intimidating, but there are others. Mentors, resources, and investors want you to succeed. Just ask for help.

Above all, keep focused on your purpose. Your goals are to solve problems and improve financial services. Success will come if you prioritize customers.

You can achieve your fintech goal. Take a risk and build something unique. The world awaits your brilliant idea!

FAQs

What does the funding of fintech startups mean?

Investors raise capital to help you establish or expand a financial technology company, known as fintech startup funding.

Who funds fintech startups?

Most fintech startups source their funding through venture capital investors or firm angels, crowdfunding, and sometimes government subsidies.

What is the cost structure of a fintech firm?

The cost of a fintech can range from $50,000 to over $500,000, depending on its product offering and the market in which it operates.

What should I do to get funding for my fintech idea?

To get funding, you must build an effective business plan, contact potential financiers, and prove your uniqueness.

What qualities do investors seek in Fintech startups?

The points of consideration include whether it is innovative, if it can grow big, how it makes money, and the team behind the idea.

That’s all! You can also check out our guide on 50 Best Tech Startup Ideas 2024 and Fintech Startup Funding: How to stand out in the crowd.