401k Rollover Business Startup: Fund Your Dream Safely

A 401k rollover business startup can be one of the most powerful ways to launch your business without taking out loans or draining your personal savings.

Instead of borrowing money, you use retirement funds legally through a structured rollover process.

However, while it sounds simple, it requires the right setup, careful compliance, and a clear understanding of the rules.

So, if you’re serious about starting a business and you have a 401k, this strategy may give you the financial boost you need—without paying early withdrawal penalties.

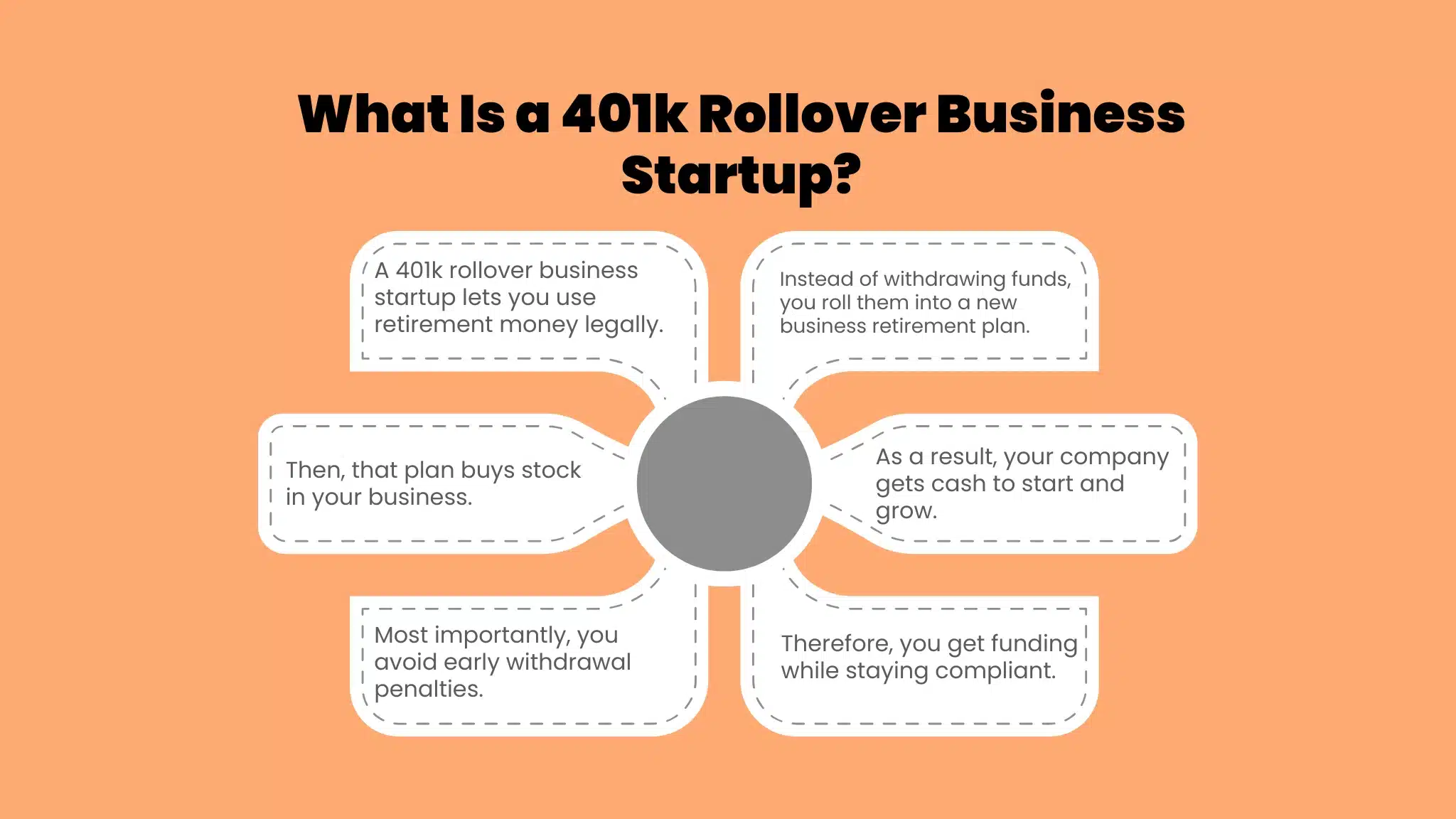

What Is a 401k Rollover Business Startup?

A 401k rollover business startup is a strategy that allows you to use money from your retirement plan to fund a new or existing business. It is often known as a “ROBS” arrangement, which stands for Rollover for Business Startups.

Instead of withdrawing your retirement funds (and paying penalties), you roll the money into a new retirement plan created by your new business. Then, the retirement plan buys stock in your company, providing cash for the business to operate.

Most importantly, this method is legal when done correctly under IRS and Department of Labor guidelines. Still, it must be structured properly to avoid major tax consequences.

Why Many Entrepreneurs Choose This Strategy

Starting a business is exciting, but money is often the biggest challenge. Fortunately, this option offers flexibility that traditional funding methods may not provide.

Here are some major reasons people choose it:

-

No early withdrawal penalties (if set up correctly)

-

No debt or monthly loan payments

-

No credit checks

-

You control your funding

-

You can invest a large amount quickly

Additionally, you keep the ability to grow your retirement funds through the new plan, depending on how you structure everything.

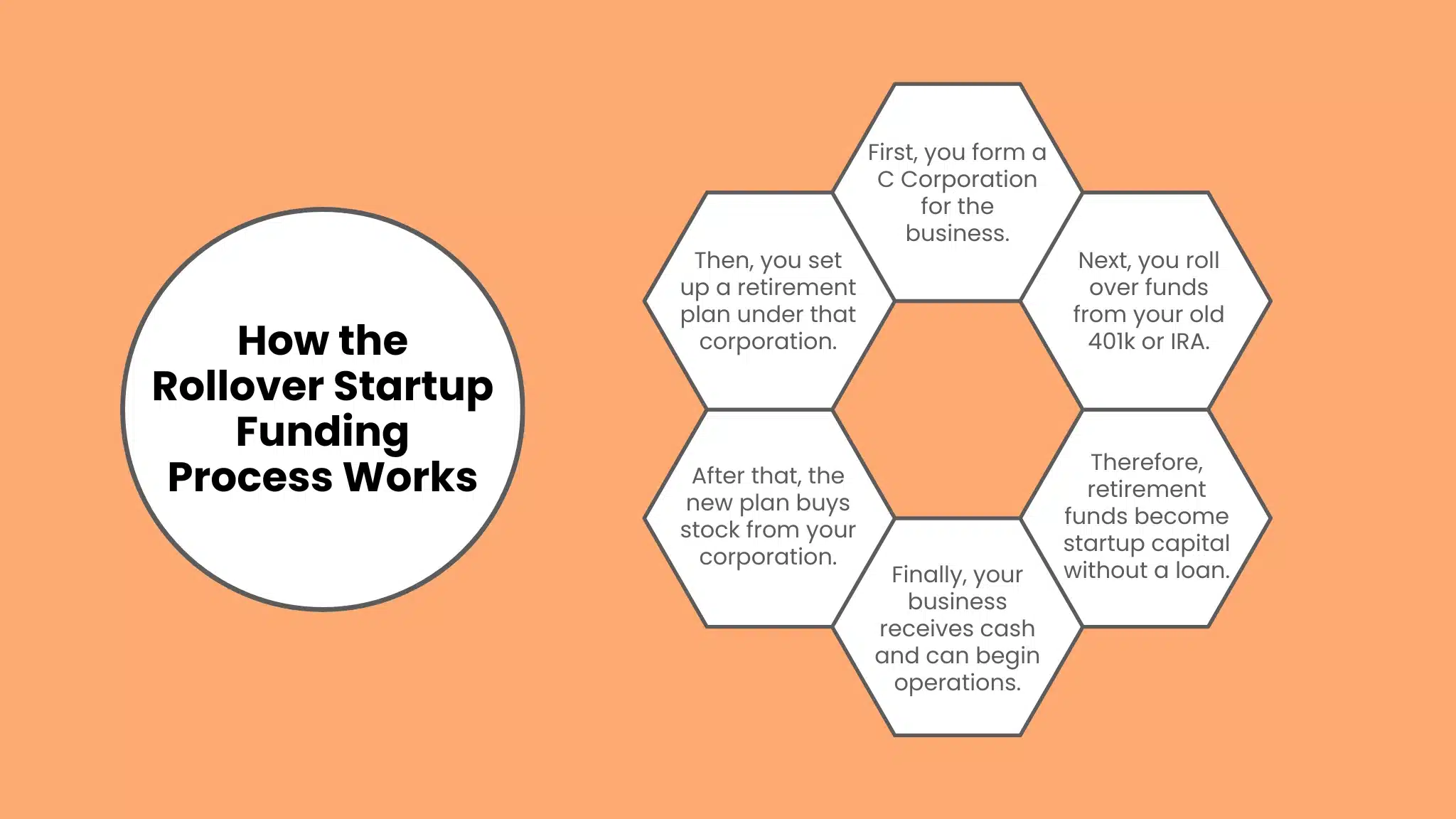

How a 401k Rollover Business Startup Works (Step-by-Step)

This process follows a clear structure. However, each step must be handled carefully.

Step 1: Form a New Corporation

To qualify, your business usually must be a C Corporation, not an LLC or sole proprietorship. That’s because the retirement plan must be able to buy company stock, and C Corps are best suited for this.

Step 2: Create a New Retirement Plan

Next, your new corporation establishes a retirement plan, typically a 401k plan. This plan must allow rollovers and investments in company stock.

Step 3: Roll Over Your Existing Retirement Funds

Then, you roll over funds from your current 401k or eligible IRA into the new plan. Because it is a rollover, not a distribution, you avoid immediate taxes and penalties.

Step 4: The Plan Buys Stock in Your Business

Now, the retirement plan uses the rolled-over funds to purchase shares of your corporation. As a result, your business receives the money in exchange for issuing stock.

Step 5: Your Business Uses the Cash for Startup Costs

Finally, your business uses the funds for operating expenses such as:

-

equipment

-

payroll

-

marketing

-

inventory

-

rent

-

franchise fees

In other words, the money becomes working capital for your startup.

Who Can Use a 401k Rollover Business Startup?

Not everyone qualifies, so it’s important to confirm eligibility before moving forward.

Typically, you need:

-

An existing 401k, 403(b), 457, or traditional IRA with funds available

-

Funds that are eligible for rollover (usually from a previous employer plan)

-

A plan to form or operate a C Corporation

-

Intent to be an employee of the business

Also, your business must offer a retirement plan to eligible employees, not just the owner. That’s a key compliance point many people overlook.

Pros of Using Your 401 (k) to Start a Business

This method can be powerful, especially if you want freedom and speed.

Here are the main benefits:

No Loan Pressure

Because you’re not borrowing money, you don’t have monthly payments. Therefore, you can focus on growth instead of debt.

Quick Access to Capital

Once set up properly, you can access funding faster than many loan processes. That helps you move quickly when opportunities appear.

Keeps Ownership in Your Hands

Since you’re not bringing in outside investors, you keep full control. As a result, decision-making stays simple and aligned with your vision.

Can Be Used for Franchise Purchases

This strategy is commonly used to buy franchises because funding needs can be high upfront. So, it becomes a strong alternative to financing.

Risks and Downsides You Must Understand

Although it can work well, a 401k rollover business startup comes with serious responsibilities. If done wrong, you could trigger taxes, penalties, and compliance issues.

Your Retirement Money Is at Risk

This is not extra cash—it’s your future. If your business fails, you may lose the retirement funds you invested.

Setup and Administration Fees

Professional setup is usually required. Additionally, you may face ongoing fees for plan administration and compliance monitoring.

IRS Scrutiny

ROBS arrangements are legal, but they often get attention from the IRS. So, you must keep everything compliant, documented, and transparent.

Employee Participation Rules

If you hire employees, your retirement plan must be offered fairly. Otherwise, your plan may be considered discriminatory, which creates legal problems.

How to Stay Compliant and Protect Yourself

To use this strategy safely, compliance is everything.

Here are best practices that make a major difference:

-

Keep your corporation and plan structure correct

-

Conduct annual plan reporting and administration

-

Offer the plan to eligible employees

-

Avoid using funds for personal expenses

-

Maintain clear records of stock transactions

-

Work with a provider experienced in rollover startup setups

Moreover, follow the rules consistently, not just during setup.

Compliance is ongoing, not a one-time task.

Common Mistakes to Avoid

Many people get excited about funding and move too fast. However, these mistakes can become expensive:

Using the Funds Before Setup Is Complete

Some entrepreneurs take money out early and plan to fix it later. Unfortunately, that can trigger immediate taxes and penalties.

Choosing the Wrong Business Entity

If you form an LLC instead of a C Corp, the strategy may not work. So, the entity structure matters greatly.

Ignoring Employee Plan Rules

Not offering the retirement plan to eligible employees is a big red flag. As a result, it can threaten the legal status of your entire arrangement.

Treating Business Money Like Personal Money

Even if you own the company, business funds must be used professionally. Otherwise, you risk audit issues and legal trouble.

When This Strategy Makes the Most Sense

This approach can be a strong option if:

-

You have at least $50,000+ in retirement funds

-

You want to avoid loans and debt

-

Your business model has clear revenue potential

-

You understand the risks and are ready to stay compliant

-

You plan to actively work in the business

However, if you’re still unsure what type of business to start, it’s better to explore profitable options first. For example, you can review these business ideas for college students to find a low-risk concept before investing retirement money.

On the other hand, it may not be ideal if you are unsure about the business or if your retirement savings are limited.

FAQs

Is a 401k rollover business startup legal?

Yes, it is legal when structured correctly under IRS and Department of Labor rules. However, compliance must be maintained continuously.

Will I pay taxes when I roll over my 401k into a startup?

No, a proper rollover is not taxable at the time of transfer. Still, mistakes in the process can trigger taxes.

What retirement accounts can be used?

Typically, old employer 401k plans, 403(b), 457 plans, and traditional IRAs are eligible. Roth accounts may have different rules.

Can I use this method if I still work for my employer?

Usually, you need access to rollover-eligible funds. If your current employer plan doesn’t allow in-service rollovers, you may not be able to use it.

Do I need professional help?

In most cases, yes. Because the setup is complex, professional guidance helps avoid costly errors.

Conclusion

A 401k rollover business startup can be a smart and powerful way to fund your business without taking on debt or paying early withdrawal penalties. However, it is not a shortcut. It requires a strict structure, ongoing compliance, and careful planning.

So, if you’re committed to your business idea and have significant retirement savings, this strategy could give you the financial launchpad you need—while staying within legal guidelines. At the same time, always remember: you’re investing your future, not just funding a project.

Also, if you’re still exploring profitable options, you may want to consider starting with a low-cost venture like a small eatery business, which can grow quickly with the right planning:

Small Eatery Business Ideas. When done wisely, it can be life-changing.