How To Set Up Automated Payments For Rental Services

You do business, and you earn money. What if you find payment issues? Sounds terrible, right?

You must work smoothly so you and your customers don’t face payment issues. But don’t you ever think about why this issue happened? This happens because your system doesn’t work accurately.

You can set up an automated payment method to eliminate this issue. I understand that not everyone knows how to do this. But you need a guide about how to set up automated payments for rental services. So, there is good news for you that this article will teach you all this.

After reading this article, you can set up an automated payment system. Let’s dive into it to get information about it.

An Automated Rent Collection – What is it?

The rental business managers will be aware of this term and know its purpose because they know how to use it. An automated rent collection is a method of paying rent to the property owner online or using any software to handle this task.

Traditional rent payment methods involve paper checks and manual payments. Still, this automated rent method enables you to pay your rent online without any hurdles.

It also provides you with the option to set scheduled recurring payments. It is a designated software directly connected to the bank account so that you can transfer money using debit cards and credit cards.

Also, Read Lease Agreements for Rental Business

Check How to Set Up Automated Payments for Rental Services

The advanced payment method changes the traditional or manual payment to the online system. This online system enables you to check all the procedures online. Here’s how you can use this method for your rental business:

Online Payments and Auto-Pay Features

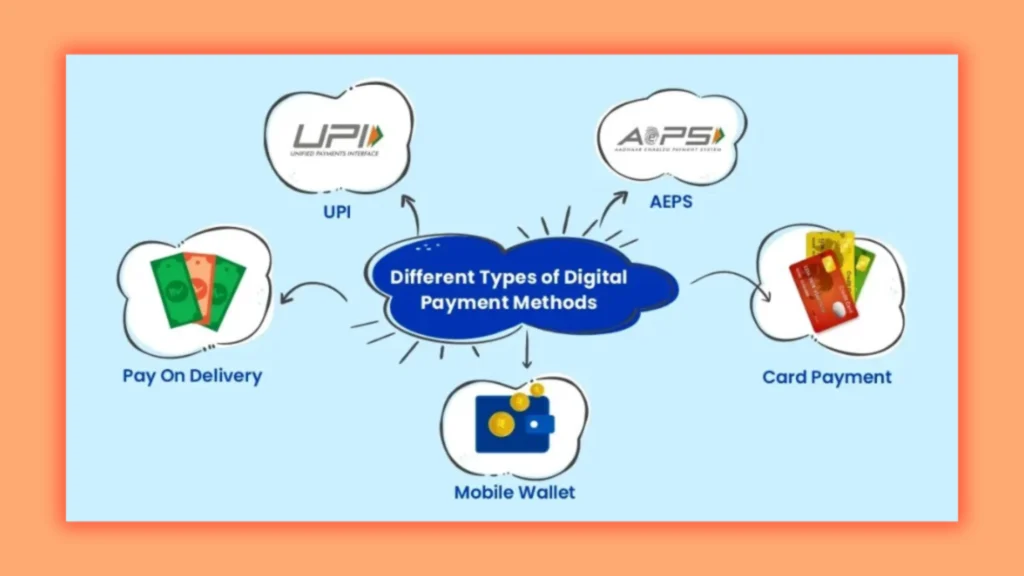

In this digit world, electronic methods ensure online payments with credit cards, ACH, or digital wallets. This lies in our auto-pay system method and leads to a streamlined system. It allows the residents to set up recurring payments that help them handle this every month.

Also, Learn about Top Rental Business Opportunities in 2025

Lockbox Services for Check Payments

Lockbox services also help management convert paper checks to online transactions. The residents must send the checks to the P.O. box, which is then processed further to allow online transactions automatically.

It’s safe because of a third-party service that then deposits the funds digitally into the property’s account, updating the payment records in the property management system without manual input from staff.

Digital Interfaces for Cash Payments

For residents who prefer cash payments, some platforms allow this too, like you can use CashPay from Zego for this purpose. They can use it and take their cash to give it to the property owner to pay their dues.

The transaction is easy to process online, and your money is directly transferred to the property’s bank account, like an electronic payment.

Also, Read How to Manage Property Rentals Efficiently

Benefits of Automating Rent Payments

Automating the payment process offers some advantages:

- It’s efficient to use and also saves you time.

- It reduces errors that can be faced when you proceed with this manually.

- Converting payments to digital formats reduces the physical handling of checks and cash, lowering the risk of theft or loss.

- You will notice an improved cash flow than they would be with manual deposit methods.

Implementing a Payment Automation System

If you want to implement this system in your business, follow these steps:

- You need to work on accessing current payment methods. You must understand what your residents want and which options they prefer nowadays.

- Try to select the right tools. You must choose technologies; for example, you can use a mobile payment app. This will help you convert the payment type used by the customers.

- Tell your residents and educate them about this online system. Tell them how they can use this and how it helps them and saves their time.

- It gives security, simplicity, and flexibility to automated payments.

- After implementation, check the system’s performance and resident feedback to tweak and improve the process.

Also, Learn The Key Considerations For Starting a Rental Business

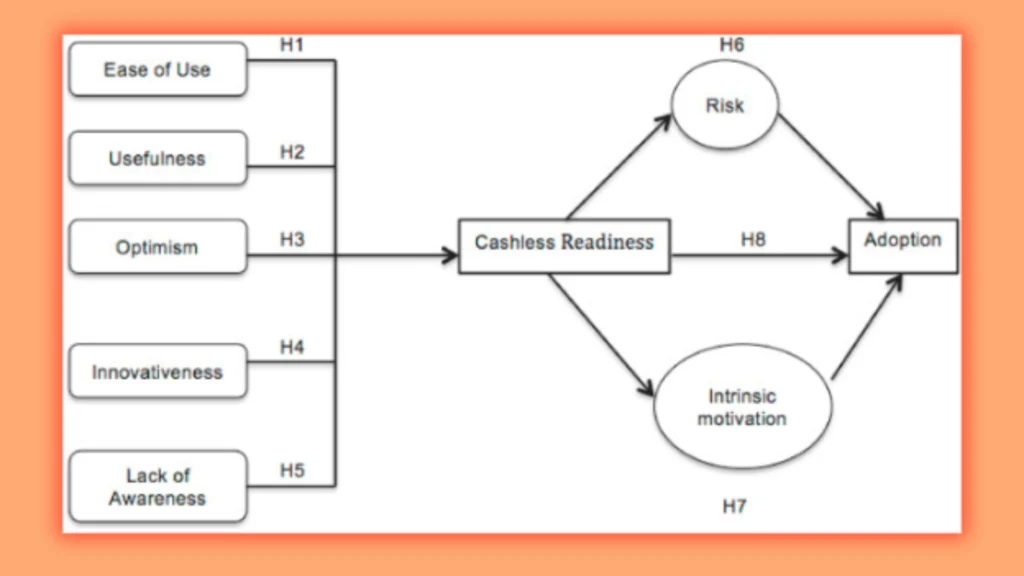

Driving Digital Payment Adoption Among Residents

You should promote this automated payment method and ask your customers to use it. These methods need:

- Offer small discounts and other benefits to attract more people to use this service.

- It provides clear, simple instructions and support for setting up and using new payment methods, which can ease the transition for residents.

- It helps residents to share their experiences and give feedback to suggest improvements to make the system work better for everyone.

- Property managers can significantly increase their properties’ operational efficiency by automating all resident payments.

- This makes the rent collection process smoother and more secure and improves resident satisfaction by accommodating diverse payment preferences.

Utilizing these changes strategically and thoughtfully can lead to a more streamlined, effective property management operation.

Conclusion

This guide tells you how to set up automated payment methods for rentals that enable you to comfort your customers and run your business more effectively. Through this, your customers will have ease, and you won’t have to work as hard as you do when you handle it manually. You can visit us for further details!

FAQs

Can you set up a direct debit for rent?

You can set up a direct debit and can manage the payment procedure. Once you have authorization from the tenant, you can collect rental payments on the day they are due without contacting the tenant each month.

Can rent expenses be debited?

Lessees would simply record a debit to rent expense and a credit to cash, reflecting the cost of using the leased asset and the payment made within the same period.

How do you calculate rent expenses?

Determine the cost of the lease for its entire period, including free months, discounted months, or months that go up because of inflation. The amount must then be divided by the total months covered under the lease.