How to Manage Risk in Rental Agreements – All You Need to Know

Have you ever thought of owning a business that does not have any risk that you must face in the future or with running a business?

No, no business comes without risks; you have to face different hurdles and troubles while earning through your company. And when you own a rental business, you may face many agreement risks. Because every industry has its terms and policies to follow, you are restricted from obeying them.

You must learn to manage risk in any of your business, no matter what kind of business you are running, but you have to be able to manage it. This particular guide will teach you how to manage risk in rental agreements.

So, let’s dive into it to get all the information!

How to Manage Risk in Rental Agreements

Some tips can help you manage the risks in your rental business. Let’s explore the following tips to learn how to manage risk in rental agreements:

Understanding Rental Property Ownership

If you are a property landlord, you can reduce risk by knowing who owns rental properties. Unlike real estate investment trusts (REITs), most landlords are small business owners.

Many real estate investors pool funds to purchase rental properties in a REIT. As a result, the risk is restricted to a single investor, such as homeowners purchasing modest buildings.

A lot of proprietors of rental properties gradually expand their portfolio of inventions. Before locating the best lender, they frequently work with a realtor knowledgeable about the local real estate market and home values.

They have to be sure the rental property brings in enough money to pay the mortgage if they take out a loan. Many owners of rental properties do repairs and upgrades to raise the property’s value.

Also, Read How To Create a Customer Loyalty Program For Rentals

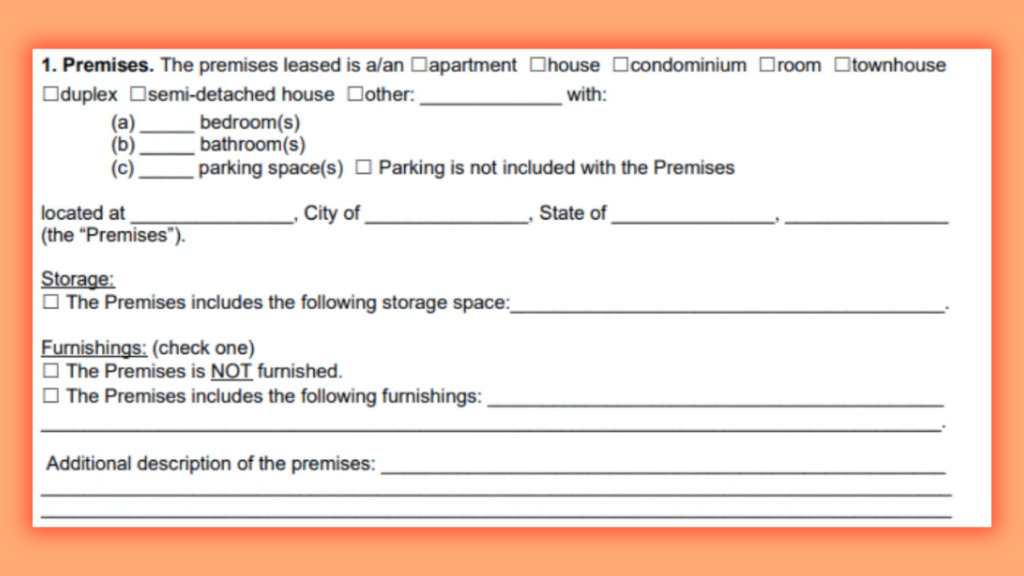

Use a Written Lease Agreement

A written lease is more than just a legally enforceable contract. Tenants and owners of rental properties are both protected under leases. They specify each party’s obligations and liabilities. Oral agreements raise a landlord’s risk even if permitted in many states. A written contract will govern the resolution of a disagreement between a landlord and tenant.

Many landlords, often small business owners, may draft their lease agreements to save money, but this frequently backfires. A knowledgeable local real estate lawyer can help them save time and money by creating a legally sound agreement.

Here are a few terms of the lease to include in a strong lease agreement:

- The amount of the security deposit

- The amount of the monthly rent and the due date

- Where to make rent payments

- Move-in date

- Deposits and fees

- Term of the tenancy

Obtain Adequate Insurance

Purchasing the appropriate kind of insurance for a rental property can guarantee protection against mishaps and property damage. One strategy to safeguard your investment property is to do this.

Learn about the different insurance categories:

- You will learn about personal liability insurance, in which you will see severe conditions like slip-and-fall incidents, criminal activities, and other events.

- So this way, property insurance will protect you from physical and structural damage to your property.

Also, Learn How To Attract Corporate Clients For Kayak Team Building Events

Prevent Violations of Fair Housing

When choosing a tenant, discriminatory housing practices are prohibited by both federal and state legislation. You must focus on:

- Race

- Color

- National origin

- Gender

- Religion

- Familial status

- Disability

Treating each potential tenant somewhat is crucial when choosing one. A landlord should do none of the following:

- Refuse to acknowledge the existence of a rental property.

- Incorporate constraints or preferences into an advertisement.

- Establish distinct conditions or requirements for specific tenants.

- Terminate a lease due to discrimination.

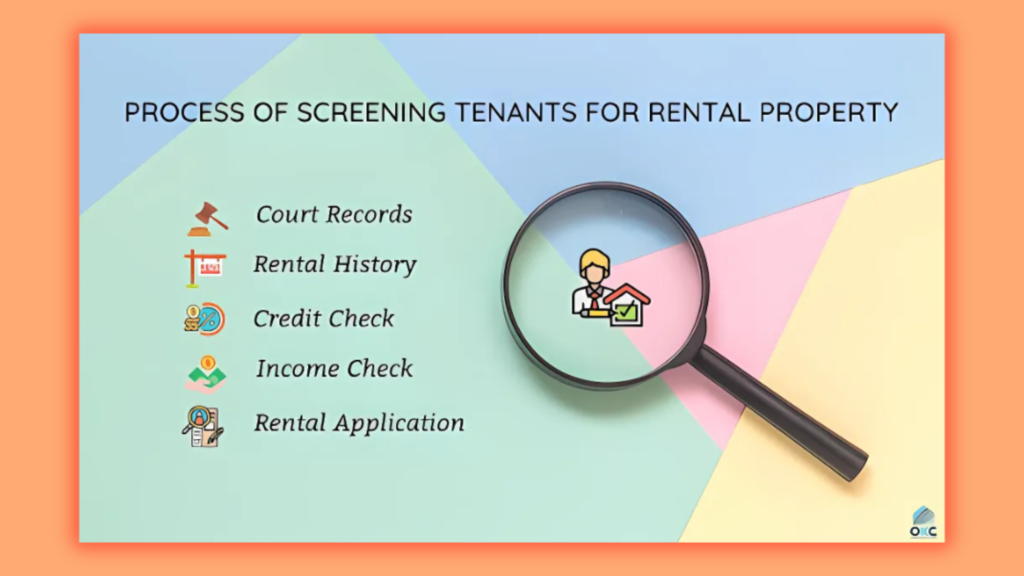

Consistent Tenant Screening Process

A landlord should establish an appropriate application process to prevent fair housing complaints by:

- Having a screening procedure created.

- Rejecting renters only when they have reasonable cause, including low income, poor credit, or a bad reference from a prior landlord.

- Granting tenants with disabilities adequate accommodations.

- Enforcing the same application procedure for all potential tenants

Employ a Property Management Firm

You should employ a property management firm. This strategy works better for single-house families, but you will find it challenging to manage when you use it for multiple housing families.

From background checks to the rental application, the property owner can get help from a skilled, trustworthy organization. They can handle all of your real estate investments due diligence requirements.

These businesses are aware of the rental industry. They can guide the rental property’s owner on matters like dwelling unit pricing. They can also help distinguish between qualified and unqualified tenants.

Also, Read How To Set Up an Online Booking System For Kayak Rentals

Provide for Tenants with Disabilities

The federal Fair Housing Act requires rental property owners to provide accommodations for renters with disabilities.

A landlord needs to:

- Provide tenants with disabilities with access to the property. Wheelchair accessibility is required in the leasing office and other public spaces.

- Provide for the tenant with a disability. The rental unit and communal areas must be equally accessible to renters with disabilities. Providing a parking area that is easily accessible is part of this.

- Permit appropriate changes. If suitable, a disabled person may change the rental property at their own cost. Lowing cabinets or building a wheelchair ramp are typically regarded as appropriate.

Make the Land Habitable

A landlord must give a tenant a rental property suitable for habitation under the implicit warranty of habitability incorporated into leases. The landlord must adhere to local building and safety rules while the tenant resides there.

Generally speaking, a rental property has to have:

- Gas for Heating and Plumbing

- Pure water and electricity

- A structurally sound roof

Resolve Hazardous Situations

Additionally, a landlord has to check the property for dangers regularly. Tenants and guests must be warned of the threat if the landlord cannot immediately address a hazardous condition.

For injuries brought on by the following, the owner of the rental property may be held legally liable:

- Carelessness

- Inattention

- A breach of a safety or health code

- The neglect of some maintenance

Also, Read Peer-to-Peer Rental Business Opportunities

Recognize the Tax Repercussions

You must have all your business records because you can require them at any time. Set a meeting with your lawyer and get all the essential things done.

The following are examples of tax and accounting considerations:

- Business structure type

- Losses and passive income

- Deductions for businesses include payroll and property taxes

Conclusion

Once you know how to manage risk in rental agreements, you have won the half-game already. These necessaries will lead ou to an extent of the business. You must work on them so that you meet no worries in the future regarding these risks in the industry.

If you have any queries, you can freely approach our experts to guide you, so what are you waiting for? Let’s get started and win the race.

FAQs

What is the most efficient way to manage risk?

- Identify the risks your organization faces.

- Assign levels of severity to risks.

- Develop plans to mitigate risk.

- Monitor controls for effectiveness.

- Communicate risk.

- Continuously assess and adjust strategies and plans.

How to measure contract risk?

You can assess your contractual risk by doing the following:

- Assess the counterparty.

- Review your obligation under the contract.

- Evaluate timelines and milestones.

- Review contract terms.

- Note risks specific to a location.

- Ensure regulatory compliance.

What are the five 5 measures of risk?

- Alpha.

- Beta.

- R-squared.

- Sharpe ratio.

- Standard deviation.