Startup Business Loans With No Revenue: 2026 Best Guide

Startup business loans with no revenue may sound impossible, but many founders still get approved.

Today, lenders do not rely only on sales. Instead, they look at your business plan, credit score, personal income, and market potential.

So, if you are starting a business and need money before revenue begins, you still have options. With the right steps, getting approved is more realistic than most people think.

Why Getting a Startup Business Loans With No Revenue Is Hard

Most lenders use revenue to judge risk. Revenue shows that a business is active and stable.

However, startups often have no income in the beginning. Even so, lenders may approve your loan if you can prove you will be able to repay it.

That is why it is important to apply for loans made for early-stage startups, not traditional business loans meant for established companies.

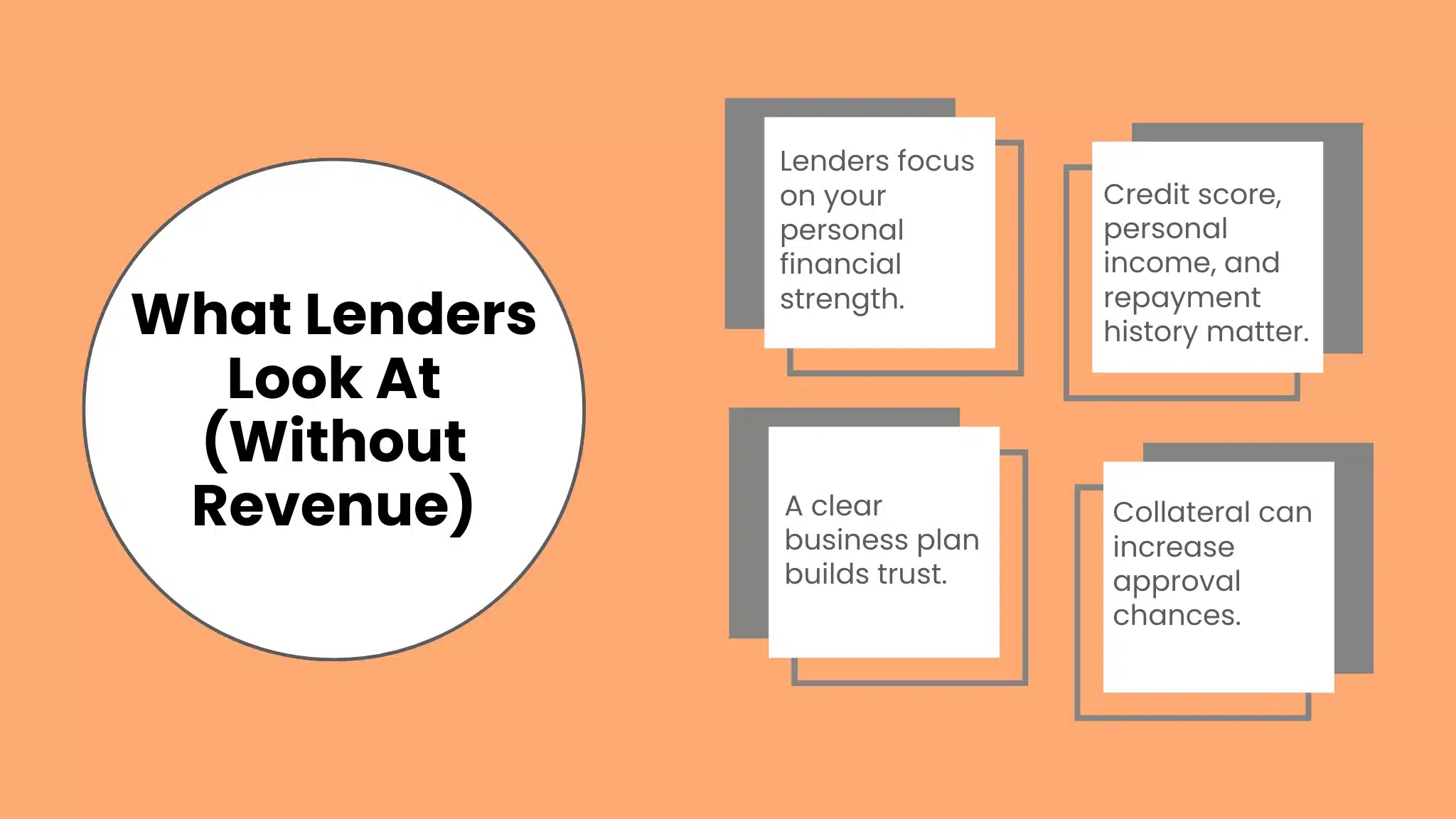

What Lenders Look For When You Have No Revenue

Even without business income, lenders still check important things before approving a loan.

Personal Credit Score

Most lenders prefer a credit score above 650. However, some lenders accept lower scores if your overall profile is strong.

Personal Income or Employment

If you have a job, freelance work, or stable income, it helps because lenders want proof you can repay.

Startup Business Plan

A clear business plan shows that you understand your market and have a realistic strategy.

Collateral (Optional But Helpful)

Some lenders approve loans faster if you offer something valuable, like savings, property, or a vehicle.

Cash Flow Forecast

Even if you have no revenue yet, future income estimates matter. Lenders prefer realistic projections based on research.

Best Startup Business Loans With No Revenue

Below are some of the best ways startups can get funding before they start earning.

1. SBA Loans (Microloans and Community Programs)

The SBA Microloan Program is one of the best options for startups with low or no revenue.

These loans come through nonprofit lenders and can help you buy inventory, equipment, or cover working costs.

Why it works:

-

Designed for startups and small businesses

-

Often lower interest rates

-

Some lenders approve with no revenue if your plan is strong

Best for: startups needing $5,000 to $50,000.

2. Business Credit Cards (Fast and Flexible)

Business credit cards are one of the easiest ways to fund a startup with no revenue.

Most approvals depend on your personal credit, not your business income.

Why it works:

-

Fast access to money

-

Helps build business credit

-

Rewards and cashback can reduce costs

Important tip: Keep your credit use under 30%. This helps protect your credit score.

3. Personal Loans Used for Business Purposes

Many founders use personal loans to cover startup costs.

These loans depend on your personal credit and income, so revenue is not required.

Why it works:

-

No business revenue needed

-

Good for startup expenses

-

Often approved faster than business loans

However, borrow only what you can repay. Missed payments can quickly damage your credit.

4. Equipment Financing (Loan Based on the Equipment)

If you need computers, machines, or tools, equipment financing can work well.

The equipment acts as collateral, which makes lenders more willing to approve you.

Why it works:

-

Revenue is not always required

-

Lower risk for lenders

-

Keeps your cash available for other needs

Best for: startups in construction, restaurants, delivery, healthcare, or tech.

5. Invoice Financing (If You Have Contracts)

Even without revenue, you may qualify if you already have invoices or signed client contracts.

Invoice financing gives you money upfront, based on what customers will pay later.

This option works especially well for founders who are launching service-based startups or planning businesses in industries like food, catering, or delivery. If you’re exploring low-investment business models, you can also check out these unique food business ideas to find profitable options that may help you secure contracts faster:

https://reliablestartup.com/business-ideas/12-unique-food-business-ideas/

Why it works:

-

Based on invoices, not revenue history

-

Useful for service startups with contracts

Best for: consulting firms, agencies, and B2B service startups.

6. Startup Grants (No Repayment)

Startup grants are not loans, but they are great funding options.

Grants do not require repayment. Instead, they focus on your business goal, impact, and feasibility.

Why it works:

-

Free funding

-

Great for women-owned, minority-owned, and innovation-based startups

However, grants may take time and require strong applications.

7. Crowdfunding (Raise Money and Build an Audience)

Crowdfunding helps startups raise funds from people who like the idea and want to support it.

This is not based on revenue. It depends on how well you present your product and how much interest it creates.

Why it works:

-

No debt

-

Builds early audience

-

Strong marketing opportunity

A good pitch, clear message, and good visuals increase success.

Smart Tips to Improve Approval Chances (Even With No Revenue)

To improve your chances of approval, follow these simple steps.

Build Your Business Credit Early

Open a business bank account, register your business, and start using small vendor accounts.

This builds trust and improves your profile.

Apply for Smaller Amounts First

Start with $5,000 to $20,000 instead of asking for a large loan.

Smaller requests are easier to approve.

Show Proof of Market Demand

If you have pre-orders, contracts, or a waiting list, include them in your application.

Even small proof shows lenders you have real demand.

Avoid High-Cost Lenders

Some lenders charge very high interest and fees for no-revenue loans.

Always check the full cost, repayment terms, and any hidden charges.

Common Mistakes Startups Make When Applying

Many founders get rejected because of simple mistakes.

-

Applying without a clear business plan

-

Mixing personal and business spending

-

Asking for too much too early

-

Ignoring credit score health

-

Not showing repayment ability

Instead, stay organized, provide strong documents, and apply with realistic goals.

FAQs

What is the easiest startup business loan to get with no revenue?

Business credit cards and personal loans are usually the easiest because they depend on your personal credit and income.

Can I get an SBA loan with no revenue?

Yes, some SBA microloan lenders may approve startups without revenue if you have a strong plan and good repayment ability.

How much can I borrow for a startup with no revenue?

Many startups borrow between $5,000 and $50,000 through microloans, credit cards, or equipment financing.

Do startups need collateral to get approved?

Not always. Some loans do not require collateral, but offering it can improve approval chances.

What credit score do I need for startup business loans?

Most lenders prefer 650 or higher, but some lenders accept lower scores depending on your income and other strengths.

Conclusion

Getting startup business loans with no revenue is possible if you choose the right funding option. First of all, you need to understand which loan type fits your startup stage and repayment ability.

While traditional banks may reject new businesses, microloans, credit cards, personal loans, and equipment financing can help you start. For example, many founders begin with smaller funding options to build trust and improve approval chances. If you are still in the planning stage and looking for practical startup inspiration, you can also explore these business ideas for college students to choose a low-cost idea that can grow quickly.

The key is to show lenders that you are prepared and can repay. In addition, having a strong business plan and clear financial projections can make a big difference. As a result, you’ll be able to launch with confidence and focus on growing revenue quickly. Finally, staying consistent with repayments will help you qualify for bigger funding later.