Startup Business Credit Cards With No Credit: Best Options

Startup business credit cards with no credit are a practical option for founders who are just getting started and don’t have a long credit history. Many entrepreneurs assume they must already have strong credit to get approved. However, that’s not always true.

Today, there are secured business credit cards, corporate charge cards, and startup-friendly business cards that can help you qualify even when your credit profile is thin. More importantly, the right card can support cash flow, organize spending, and help build business credit over time.

In this guide, you’ll learn the best real options available, how these cards work, and how to choose the right one without confusion.

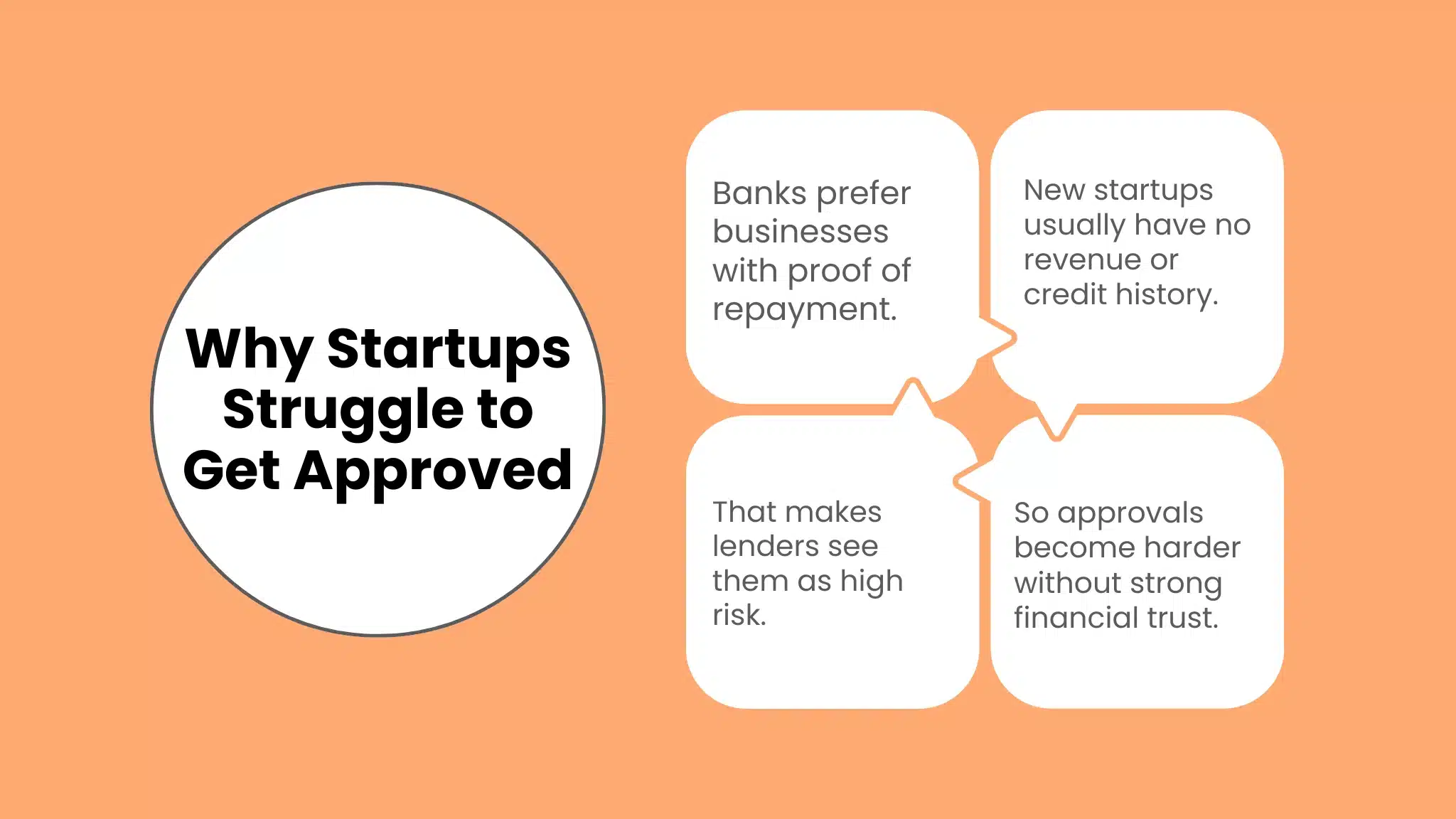

Why Startups Struggle to Get Traditional Business Credit Cards

Traditional banks prefer business owners with proof that they can repay what they borrow. That’s why they often check:

-

Personal credit score

-

Business revenue

-

Time in business

-

Existing business credit history

Because most startups don’t have these factors yet, approvals are difficult. Still, there are alternatives. Therefore, instead of waiting, you can start with options built specifically for early-stage businesses.

How Startup Business Credit Cards With No Credit Work

Most “no credit” business cards fall into these categories:

1) Secured Business Credit Cards

These require a refundable security deposit. As a result, approvals are easier because the issuer has less risk.

2) Corporate Charge Cards

Some corporate cards focus on cash flow and bank balances instead of personal credit. In many cases, they also avoid personal guarantees.

3) Startup-Friendly Business Credit Cards

These cards may still review personal credit, but they often approve thin credit files—especially if you have steady income or savings.

Best Startup Business Credit Cards With No Credit (Real Options)

Below are realistic choices for founders with no established credit history. Each option works differently, so your best choice depends on how new your business is and how much cash you can manage responsibly.

1) Corporate Startup Cards (Cash Flow Based)

Corporate startup cards are often the best option when you don’t want your application to rely on personal credit. Instead, these providers look at business cash flow, bank balances, and spending patterns.

Why founders choose them:

-

They often do not require a personal credit check

-

They can offer larger spending limits compared to secured cards

-

They include tools that make expense tracking easier

Best for: Startups that already have a business bank account and consistent deposits.

However, corporate cards commonly require you to pay the balance in full each month. So, if your cash flow is unstable, it may be smarter to start with a secured option first.

2) Secured Business Credit Cards (Most Reliable)

If you have no credit or very limited credit history, secured business cards are usually the easiest to get. You provide a deposit, and the issuer gives you a credit limit based on that deposit. Because of this, secured cards are often the fastest way to build business credit safely.

Why secured cards work well:

-

Approval is easier

-

You control risk by choosing the deposit amount

-

They help build credit habits early

Best for: New startups, freelancers, and business owners with thin or no credit history.

Even though secured cards feel like a “starter option,” they’re incredibly powerful. Over time, consistent payments can help you qualify for better business cards without needing to rely heavily on personal credit.

3) Startup-Friendly Traditional Business Credit Cards

Some traditional business credit cards are available to new business owners, even when the business itself has no credit history yet. That said, these cards usually depend on the owner’s personal credit score.

Why they’re still worth considering:

-

Rewards programs can be valuable early on

-

Some offer introductory benefits

-

You can separate business and personal expenses

Best for: Founders with fair-to-good personal credit, even if the business is brand new.

If your personal credit isn’t strong yet, it’s better to build credit first using a secured card or corporate option. Otherwise, you may face unnecessary rejections.

How to Choose the Right Card (Simple Startup Checklist)

To avoid mistakes, choose a card that matches your situation today—not the situation you hope to be in later.

Choose a secured card if:

-

Your business is brand new

-

You don’t have strong income proof

-

You want the easiest approval route

Choose a corporate startup card if:

-

You have consistent deposits and stable cash flow

-

You want no personal credit dependency

-

You need spending controls for a growing team

Choose a traditional startup-friendly business card if:

-

You already have fair-to-good personal credit

-

You want rewards like cash back or points

-

You can meet normal bank approval standards

Tips to Get Approved With No Credit (Real Steps)

Even with no credit history, you can still improve your approval chances quickly by doing a few simple actions.

1) Register Your Business Properly

Set up your business legally and keep documentation organized. This improves credibility and reduces issues during application checks.

2) Get an EIN and Open a Business Bank Account

This step matters because lenders want to see that your business is real and financially separate from personal spending.

3) Build Cash Reserves

Even if you don’t have revenue yet, maintaining savings shows stability. Corporate card providers often view this as a key approval factor.

4) Start With Smaller Limits

You don’t need a huge credit line to begin. Instead, start small and build gradually. This approach improves approval odds and reduces risk.

5) Pay Early, Not Late

Early payments build trust faster. In addition, they protect your business from interest costs and late fees.

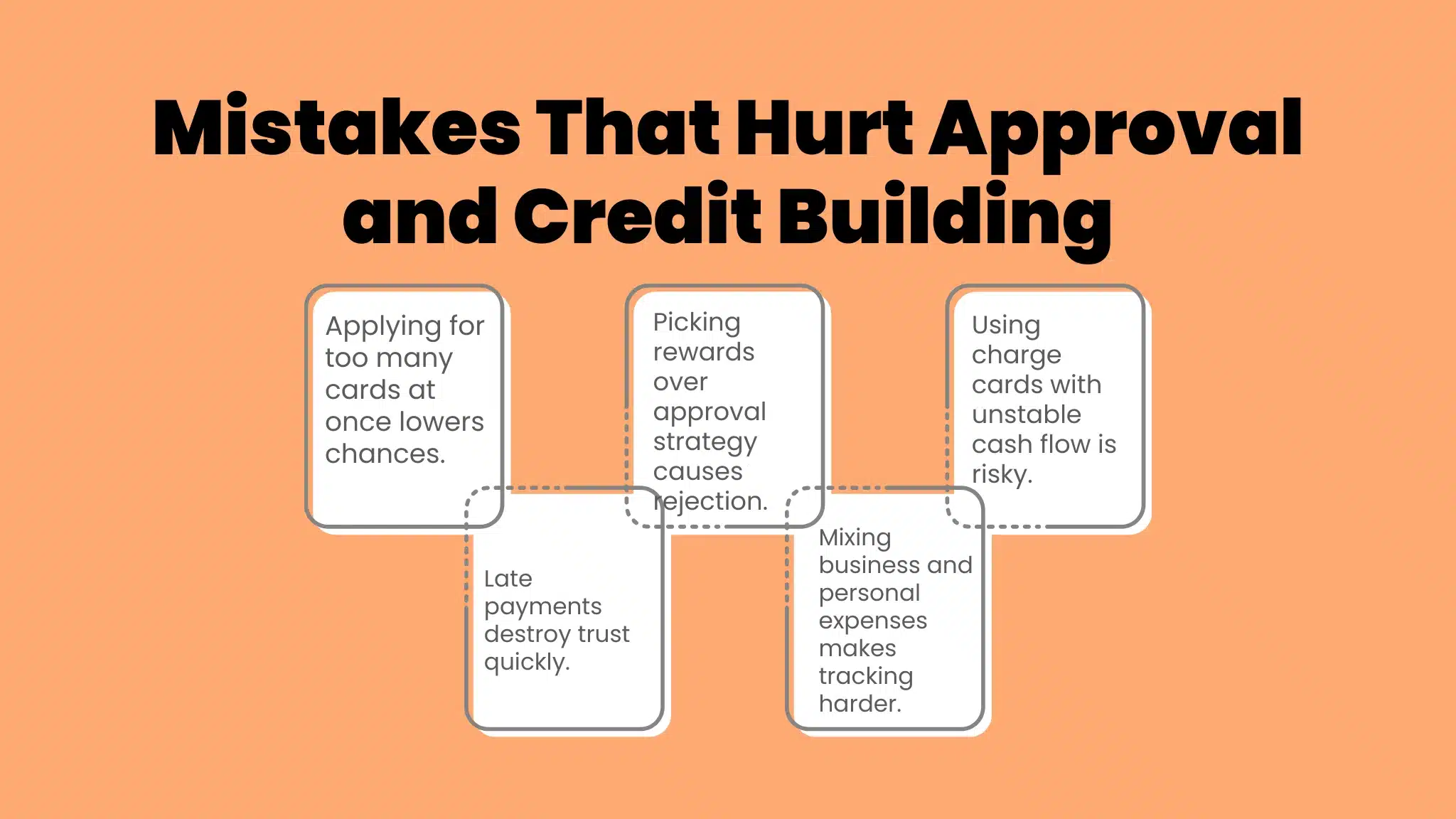

Mistakes Startups Should Avoid

Many founders get rejected or stuck in debt because they rush into the wrong credit card choice. Therefore, avoid these common mistakes:

-

Applying for too many cards at once

-

Choosing rewards over approval chances

-

Using a charge card when cash flow is unpredictable

-

Missing payments or paying only the minimum

-

Mixing personal and business expenses

Instead, treat your first business credit card as a tool for growth—not a shortcut to borrowing.

How These Cards Help You Build Business Credit

Startup business credit cards with no credit are a smart entry point for founders who want funding flexibility without waiting years to build a strong credit profile. While traditional business cards can be difficult to get early on, secured business cards and corporate startup cards make it possible to start today.

If your business is brand new, a secured business credit card is usually the safest option. On the other hand, if you have stable cash reserves and consistent cash flow, a corporate startup card can offer stronger controls and higher limits without relying heavily on personal credit.

Most importantly, start with the card you can manage responsibly. Then, as your business grows, you can upgrade to better rewards, higher limits, and stronger financing options. Additionally, if you’re still exploring profitable startup opportunities, you can check out 12 Unique Food Business Ideas to find inspiration that can work well with smart business funding strategies.

FAQs

Can I get a startup business credit card with absolutely no credit?

Yes. Secured business credit cards are usually the easiest option because approval is based on your deposit rather than credit history.

Do corporate startup cards require a credit score?

Often, corporate startup cards focus on cash flow and business banking data, not personal credit score. However, requirements vary by provider.

Are secured business credit cards safe?

Yes. They’re one of the safest ways to start because you control the deposit and the limit. As a result, your risk is lower.

Will a business credit card build business credit?

It can, but only if the issuer reports to business credit bureaus. Therefore, always confirm reporting before applying.

Should I apply with my EIN only?

Some corporate cards consider business financials instead of personal credit, but most traditional business credit cards still require personal information and a guarantee.

Conclusion

Startup business credit cards with no credit are a smart entry point for founders who want funding flexibility without waiting years to build a strong credit profile. While traditional business cards can be difficult to get early on, secured business cards and corporate startup cards make it possible to start today.

If your business is brand new, a secured business credit card is usually the safest option. On the other hand, if you have stable cash reserves and consistent cash flow, a corporate startup card can offer stronger controls and higher limits without relying heavily on personal credit.

Most importantly, start with the card you can manage responsibly. Then, as your business grows, you can upgrade to better rewards, higher limits, and stronger financing options. Additionally, if you’re exploring ways to build a business mindset early in life or want to inspire young entrepreneurs in your family, check out these business ideas for kids to get creative, practical inspiration.