Fractional CFO for Startups: Scale Faster With Expert Finance

If you’re building a company and the numbers feel confusing, you’re not alone. A fractional CFO for business startups gives you experienced financial leadership without the cost of a full-time executive. As a result, you make better decisions, avoid cash flow surprises, and grow with a clear plan while still keeping your budget under control.

What a Fractional CFO Actually Does for Startups

A fractional CFO is a senior finance expert who works with your startup part-time or on a contract basis. Instead of only “tracking” numbers, they help you use numbers to drive strategy.

They typically handle:

-

Cash flow planning and burn rate management

-

Budgeting, forecasting, and scenario planning

-

Pricing strategy and unit economics

-

Financial reporting and KPI dashboards

-

Fundraising prep and investor communication

-

Profitability improvement and cost control

Most importantly, they translate financial data into clear actions. So, you stop guessing and start leading.

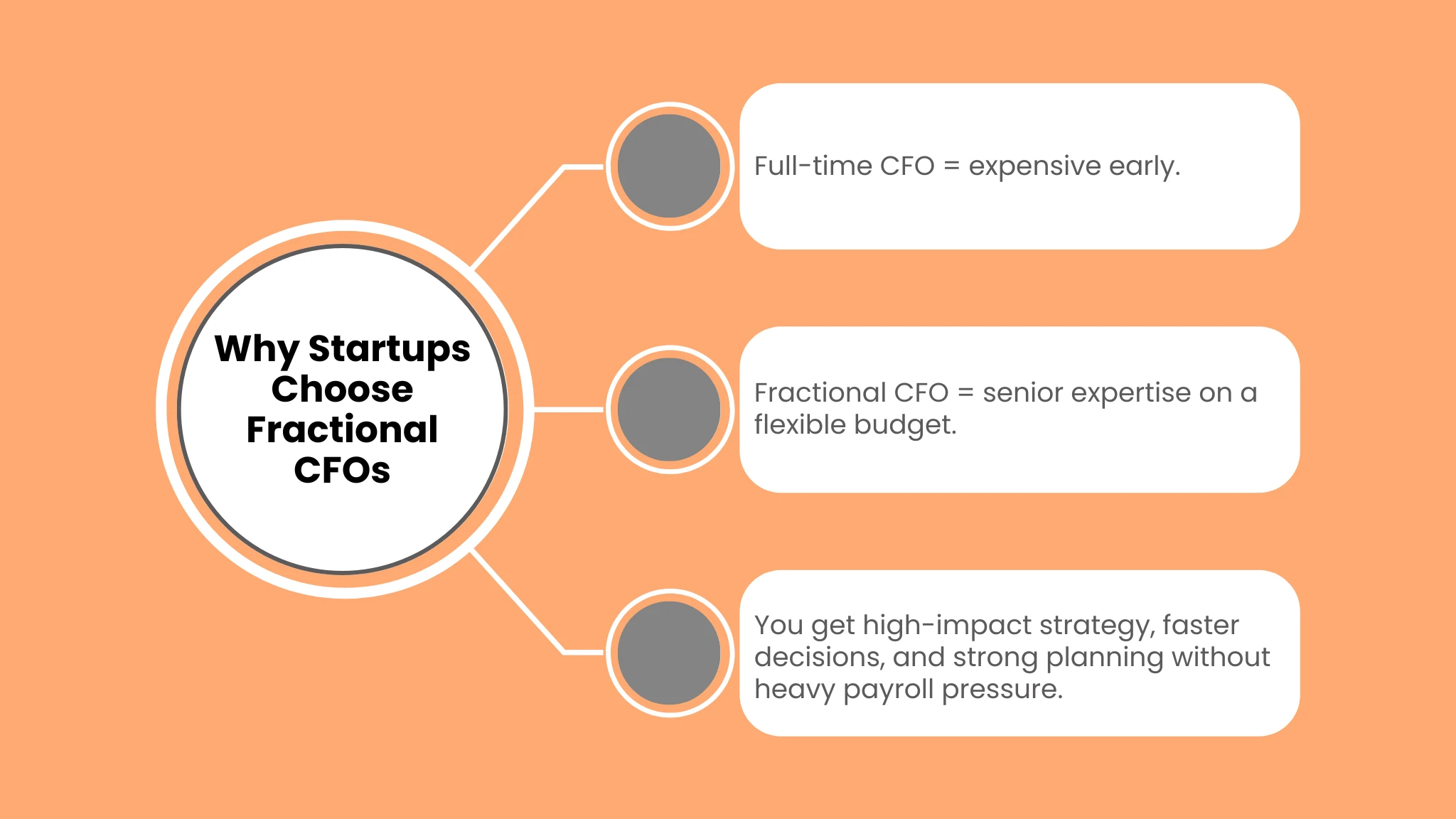

Why Startups Prefer Fractional CFOs Over Full-Time Hires

Hiring a full-time CFO early can be expensive and, sometimes, unnecessary. However, startups still need CFO-level thinking—especially when money is tight.

Key benefits

1) Lower cost, higher impact

You pay for the expertise you need, not a full salary package. Therefore, it’s easier to stay lean.

2) Faster decisions

Because fractional CFOs have seen many startup situations, they spot problems quickly. As a result, you avoid expensive mistakes.

3) Investor-ready finance

If fundraising is on your roadmap, a fractional CFO prepares your metrics, story, and financial model. Meanwhile, you focus on product and growth.

4) Stronger planning during uncertainty

Markets change fast. So, having someone who can run best-case and worst-case scenarios keeps you prepared.

When Your Startup Should Hire a Fractional CFO

Not every startup needs one from day one. Still, certain signs show you’re ready.

You should consider hiring a fractional CFO if:

-

Your revenue is growing, but profits are unclear

-

Cash flow surprises happen often

-

You don’t know your runway with confidence

-

Pricing feels like a guess, not a strategy

-

Fundraising conversations are starting

-

You’re planning to hire, expand, or enter new markets

In other words, when decisions become expensive, financial leadership becomes essential.

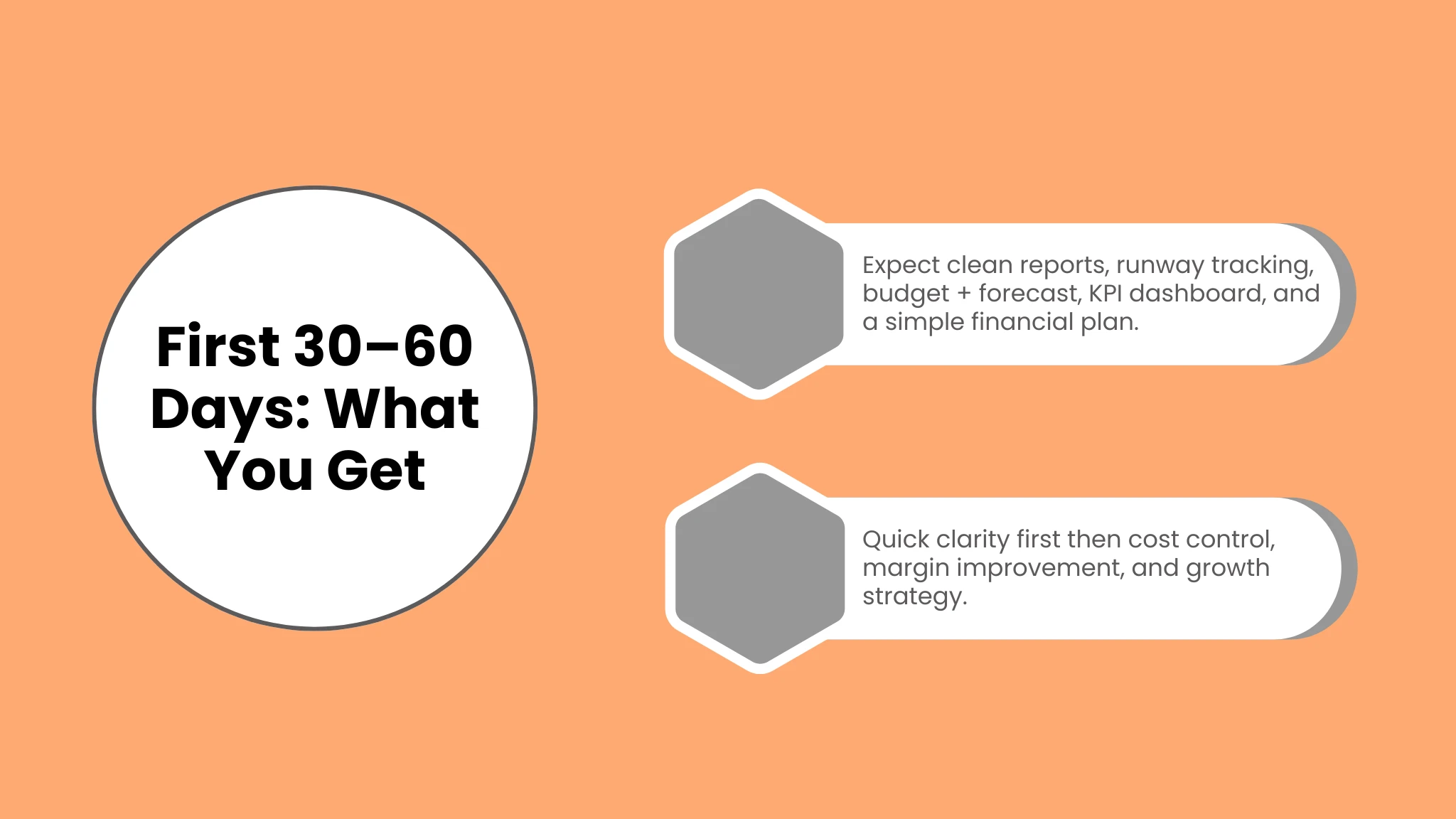

What You’ll Get in the First 30–60 Days

A good fractional CFO doesn’t waste time. Instead, they start by building clarity.

Here’s what usually happens early:

-

Review of your financial systems (bookkeeping, tools, reports)

-

Clean, simple reporting (P&L, cash flow, balance sheet)

-

A runway plan showing cash-in, cash-out, and key assumptions

-

Budget + forecast that matches your growth targets

-

KPI dashboard aligned to your business model

After that, the focus shifts to optimization—like improving margins, cutting waste, and planning smarter hires.

Fractional CFO vs Accountant vs Controller

Many founders confuse these roles. So, let’s keep it simple.

Accountant

Tracks transactions and files taxes. They record what happened.

Controller

Manages accounting processes, monthly close, and internal controls. They keep reports accurate.

Fractional CFO

Guides strategy, planning, and financial decisions. They decide what should happen next.

Therefore, an accountant supports compliance, a controller supports operations, and a fractional CFO supports growth and direction.

How a Fractional CFO Helps You Raise Funding

Fundraising is more than a pitch deck. Investors want proof, clarity, and a plan. That’s where a fractional CFO becomes a strong advantage.

They help by:

-

Building a realistic financial model with assumptions

-

Defining key metrics (CAC, LTV, churn, gross margin, payback)

-

Creating investor-ready reporting

-

Preparing data room essentials

-

Coaching you on questions investors will ask

Also, they help you avoid overpromising. That way, you protect your credibility.

Real-World Areas Where Fractional CFOs Add Value

A fractional CFO can support many parts of your business. However, these are the most common high-impact areas:

Cash flow and runway protection

Runway is survival. So, they track burn rate closely and plan ahead.

Pricing and profitability

They evaluate your costs and margins. Then, they guide pricing that supports growth.

Hiring decisions

Instead of “we feel ready,” they answer: “Can we afford it?” and “What happens if sales slow?”

KPI clarity

They build dashboards that founders actually use. As a result, teams stay aligned.

How to Choose the Right Fractional CFO

Not all fractional CFOs are the same. So, choose carefully.

Look for:

-

Startup experience in your stage (pre-seed, seed, Series A, etc.)

-

Clear communication (no confusing finance talk)

-

Strategic thinking, not just reporting

-

Strong modeling and forecasting skills

-

Comfort with your industry (SaaS, eCommerce, services, marketplace)

Also, ask about their process. If they can’t explain it simply, that’s a red flag.

Cost of a Fractional CFO for Startups

Costs depend on scope, time, and experience. Typically, startups pay monthly retainers or hourly rates.

However, the real question is value. If a fractional CFO:

-

Extends runway by 2–3 months

-

Improves margins by a few points

-

Helps close a funding round

Then the return can be huge.

So, think of it as an investment, not an expense.

Common Mistakes Startups Make Without CFO Guidance

Without CFO-level support, founders often:

-

Focus on revenue but ignore cash flow

-

Underprice products and hurt margins

-

Hire too fast and shorten runway

-

Track the wrong KPIs

-

Enter fundraising unprepared

Thankfully, these are fixable. Still, fixing them earlier is cheaper. For example, if you’re trying to extend runway quickly, choosing the right financing tools can help—here’s a helpful guide on startup business credit cards with no credit to explore safer, smarter options.

FAQs

What is a fractional CFO for business startups?

A fractional CFO for business startups is a senior finance leader who works part-time. They manage planning, cash flow, strategy, and investor readiness without the cost of a full-time CFO.

Is a fractional CFO worth it for an early-stage startup?

Yes, especially if cash flow is tight or fundraising is coming. Even a few hours per week can bring clarity and prevent costly mistakes.

When should I hire a fractional CFO instead of a full-time CFO?

If you need CFO expertise but can’t justify a full-time salary yet, fractional is the better option. Later, when complexity grows, you can move to full-time.

What should I prepare before working with a fractional CFO?

Have your bookkeeping up to date, access to bank statements, revenue data, and your current budget or plan. Then, the CFO can move faster.

Can a fractional CFO help with pricing and profitability?

Absolutely. They analyse costs, margins, and customer economics. As a result, you set prices that support sustainable growth.

Conclusion

A startup doesn’t fail only because the product is weak—often, it fails because cash and planning were misunderstood. A fractional CFO for business startups brings financial leadership at the exact moment you need smarter decisions, cleaner reporting, and a growth plan you can trust.

Therefore, if you want to scale without overspending, reduce risk, and feel confident about your runway, a fractional CFO can be one of the best hires you make especially before things get complicated. And if you’re exploring smart ways to fund your startup, check out this guide on a 401k rollover business startup to understand an alternative financing option.