Best Business Credit Cards for Startup Businesses

Starting a new business is exciting, but it also comes with a long list of expenses. That’s why business credit cards for startup businesses can be a smart tool from day one. They help you handle cash flow, organize spending, and build business credit—often without needing years of financial history.

However, not all business credit cards are created equal. So, choosing the right one is important. In this guide, you’ll learn what to look for, how startup business credit cards work, and how to use them responsibly to grow your company faster.

Why Startup Businesses Need a Business Credit Card

A startup usually runs on a tight budget. Even when sales are growing, payments can be slow and unexpected costs can pop up. Therefore, a business credit card becomes useful for everyday expenses like software, inventory, travel, or marketing.

More importantly, it separates personal and business spending. As a result, bookkeeping becomes easier and tax season becomes less stressful. In addition, business credit cards can help establish your company’s credit profile, which is essential for future loans and vendor accounts.

Key Benefits of Business Credit Cards for Startup Businesses

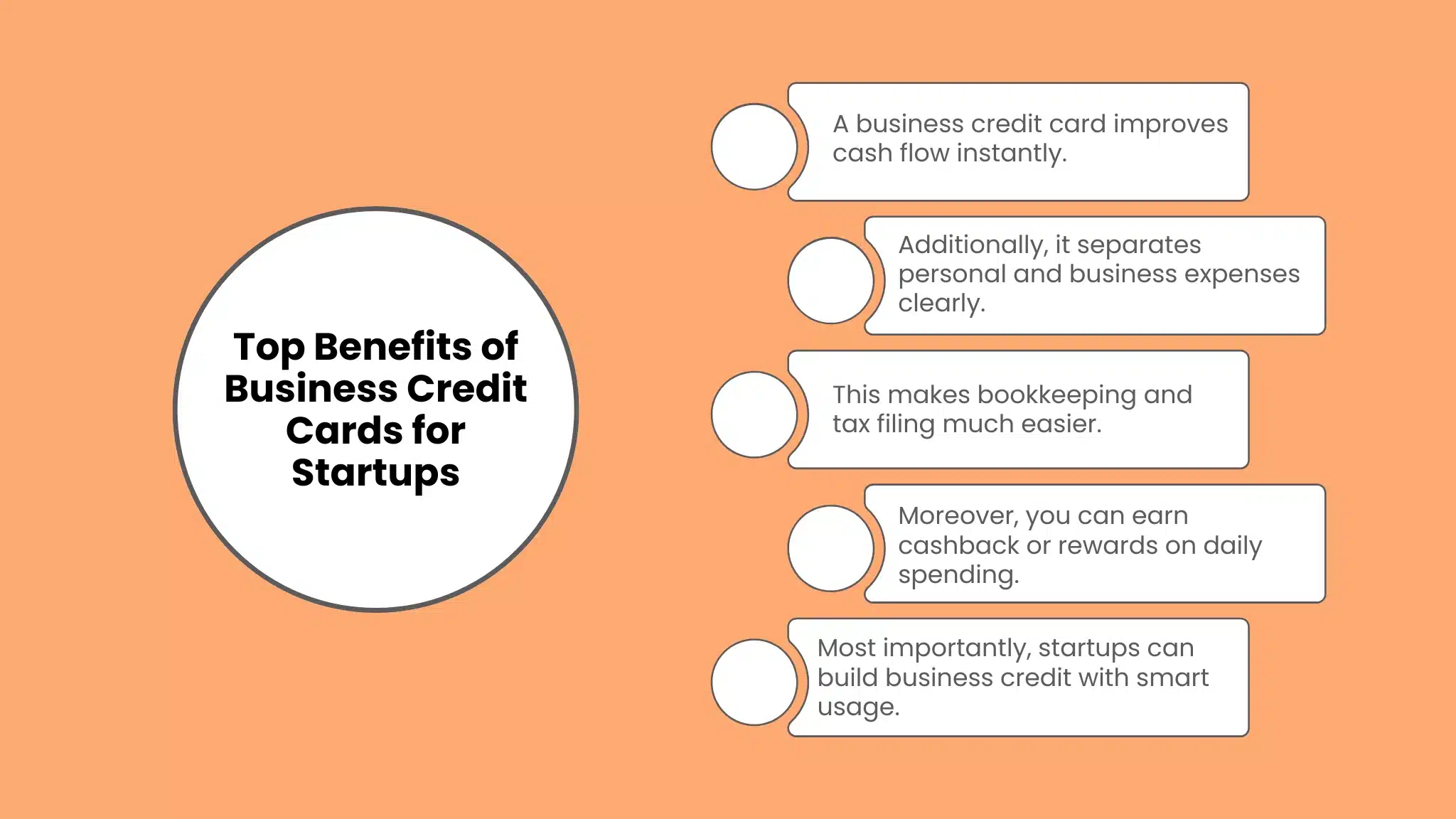

Better Cash Flow Control

Cash flow is often a startup’s biggest challenge. Fortunately, business credit cards allow you to purchase now and pay later. This breathing room can help you cover short-term gaps while you wait for invoices or sales revenue.

Expense Tracking Made Simple

Most business cards provide monthly summaries and categorized spending reports. So, instead of guessing where your money went, you can track every transaction. This makes budgeting easier and helps prevent overspending.

Rewards and Perks

Many startup founders overlook rewards. Yet, cashback and points can reduce costs over time. For example, you might earn rewards on office supplies, fuel, advertising, or travel. Additionally, some cards offer benefits like purchase protection, extended warranties, and travel insurance.

Building Business Credit

When issuers report payment history to business credit bureaus, your startup can build credit faster. Consequently, strong business credit can unlock better financing options later.

How Business Credit Cards Work for Startups

Business credit cards work similarly to personal cards, but they’re designed for business use. Typically, you get a credit limit, a statement cycle, and a due date. You can either pay the full balance each month or carry a balance with interest.

However, startups often face a common issue: limited credit history. That’s why many business cards check the owner’s personal credit score, especially for new businesses. In other words, your personal financial habits still matter in the beginning.

What to Look for When Choosing a Startup Business Credit Card

1. Approval Requirements

Some cards are startup-friendly and approve new businesses quickly. Others require a few years of operations. So, before applying, check whether the card allows startups or new LLCs.

2. Annual Fees

Annual fees aren’t always bad. In fact, cards with fees often offer stronger rewards and benefits. Still, if your startup is in early stages, a no-fee card may be the safer choice.

3. Rewards That Match Your Spending

A rewards card is only valuable if it fits your business spending habits. For example, if your startup runs lots of online ads, choose a card that offers higher cashback on advertising. Similarly, if you travel frequently, focus on points for flights and hotels.

4. Intro APR Offers

Some business credit cards provide 0% APR for several months. As a result, you can finance early expenses without paying interest. That can be very helpful when you’re launching and still building revenue.

5. Employee Cards and Spending Controls

If you have a team, employee cards are a must. They allow you to set limits and monitor spending in real time. Therefore, you maintain control while your team works faster.

Best Types of Business Credit Cards for Startup Businesses

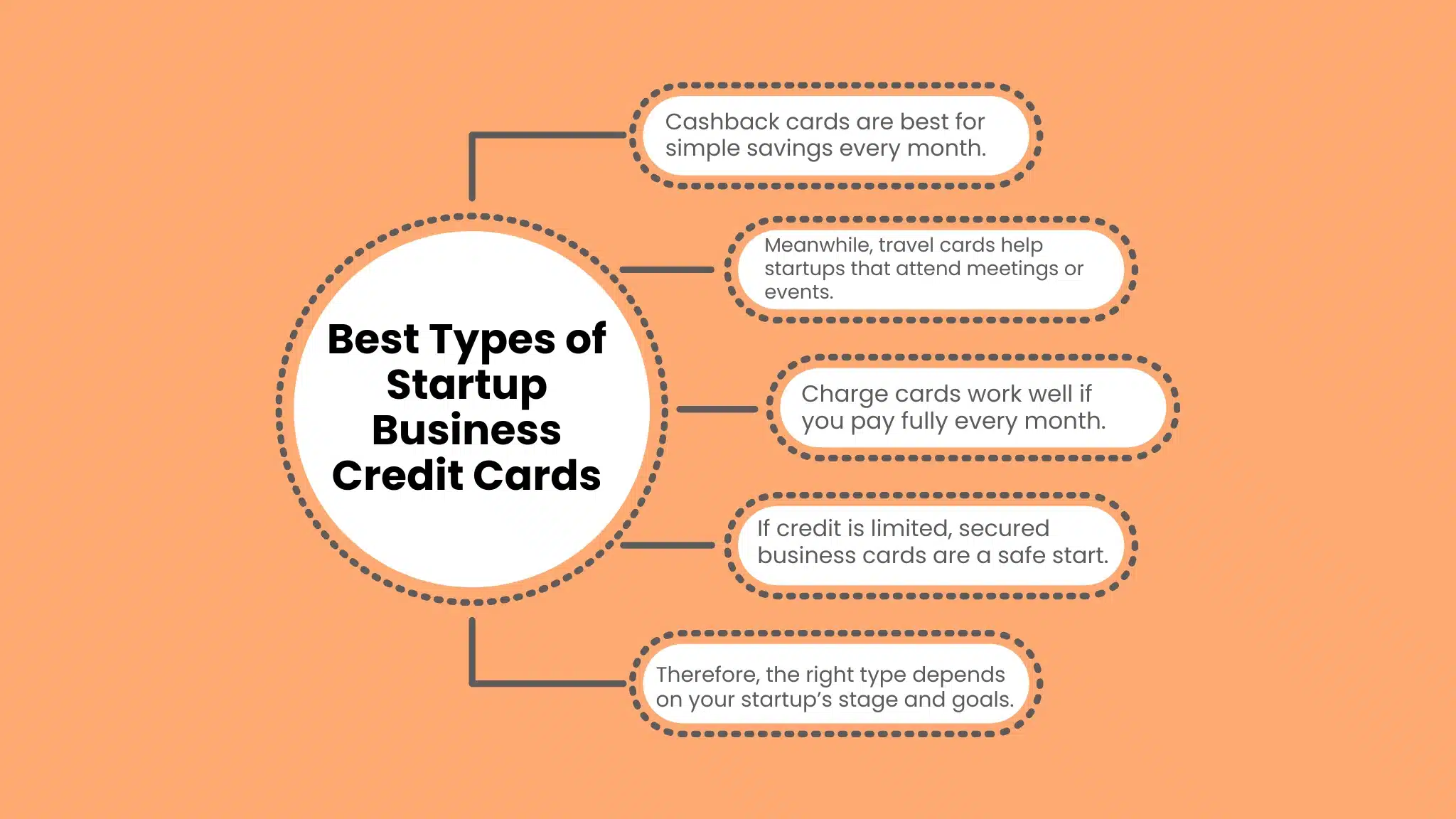

Cashback Business Credit Cards

Cashback cards are simple and flexible. They work well for startups because you can use cashback to reduce costs directly. Furthermore, you don’t need to learn complicated points systems.

Travel Rewards Business Credit Cards

If your startup includes client meetings, conferences, or supplier visits, travel cards can be valuable. Even better, many come with airport lounge access, travel insurance, and hotel perks.

Business Charge Cards

Charge cards often offer no preset spending limit, but you must pay the balance in full each month. Therefore, they’re best for startups with strong monthly revenue and disciplined budgeting.

Starter or Secured Business Credit Cards

If your credit history is limited or your business is very new, secured business cards can help. They require a cash deposit but still let you build credit. Over time, you may qualify for an unsecured card.

How to Use a Business Credit Card the Right Way

Pay On Time, Every Time

Payment history affects your credit score. So, always pay at least the minimum on time. Even better, set up automatic payments so you never miss a due date.

Keep Utilization Low

Try not to use too much of your available credit limit. Ideally, stay below 30%. This improves your credit profile and reduces risk.

Use It for Business Only

Mixing personal and business spending creates confusion. Therefore, use the business card strictly for business purchases. This keeps your records clean and professional.

Track Spending Weekly

Checking expenses once a month is not enough. Instead, review spending weekly. This way, you catch unusual charges early and stay within budget.

Common Mistakes Startups Should Avoid

Applying for Too Many Cards

It can be tempting to apply for multiple cards for higher limits. However, too many applications can lower your credit score. So, apply carefully and choose one strong option first.

Carrying a High Balance

Carrying a large balance increases interest costs. Moreover, it can hurt your credit score. Therefore, try to pay your balance in full whenever possible.

Ignoring Fees and Penalties

Late fees, foreign transaction fees, and annual fees can add up quickly. So, read the terms carefully and choose a card that matches your spending habits.

How Business Credit Cards Help Startups Grow Faster

Startups need tools that increase efficiency and reduce stress. Business credit cards do exactly that. For example, you can fund inventory, pay vendors, and invest in marketing without draining your cash reserves.

In addition, having a business credit card builds trust. Vendors and suppliers often see business credit as a sign of stability. As a result, you may qualify for better payment terms and higher credit lines in the future. This can be especially helpful if you’re planning to launch a business that needs daily operational spending, such as a small eatery business, where managing supplies, staff costs, and marketing requires consistent cash flow.

FAQs

What is the easiest business credit card to get for a startup?

The easiest business credit cards for startups are usually those that rely on the owner’s personal credit score. Many startup-friendly cards approve new businesses, especially if you have good personal credit.

Can a startup get a business credit card without revenue?

Yes, many startups can still qualify even without revenue. However, issuers may consider your personal income and credit score. In some cases, a secured card is the best starting option.

Do business credit cards build business credit?

Yes, they can build business credit if the issuer reports activity to business credit bureaus. Therefore, it’s important to choose a card that reports payments and account history.

Is a business credit card better than a personal card for startups?

Yes, because it separates expenses, offers business tools, and can help build a business credit profile. Also, it provides more professional financial management.

How many business credit cards should a startup have?

In most cases, one well-chosen business credit card is enough in the beginning. Later, you can add more cards based on spending needs and growth plans.

Conclusion

Choosing the right business credit cards for startup businesses can make a major difference in how smoothly your company operates. They help you manage cash flow, track expenses, earn rewards, and build business credit over time.

However, before applying for any card, it’s also important to have a strong business direction and a clear plan. For example, if you’re still exploring profitable opportunities, you can check out these business ideas for college students to discover smart startup options that can grow into long-term ventures.

Still, the key is to select a card that fits your startup’s spending habits and approval chances. Then, use it responsibly by paying on time and keeping balances manageable.

When used correctly, a business credit card is not just a payment tool—it becomes a growth strategy that supports your startup’s long-term success.